Behold Potential. From teak and cypress, I made her, a huge Trojan Horse. Filled with only my dreams for our children and grandchildren. Potential is not near full. There is plenty of room for more dreams. But what dreams? We need to figure that out to load fully Potential.

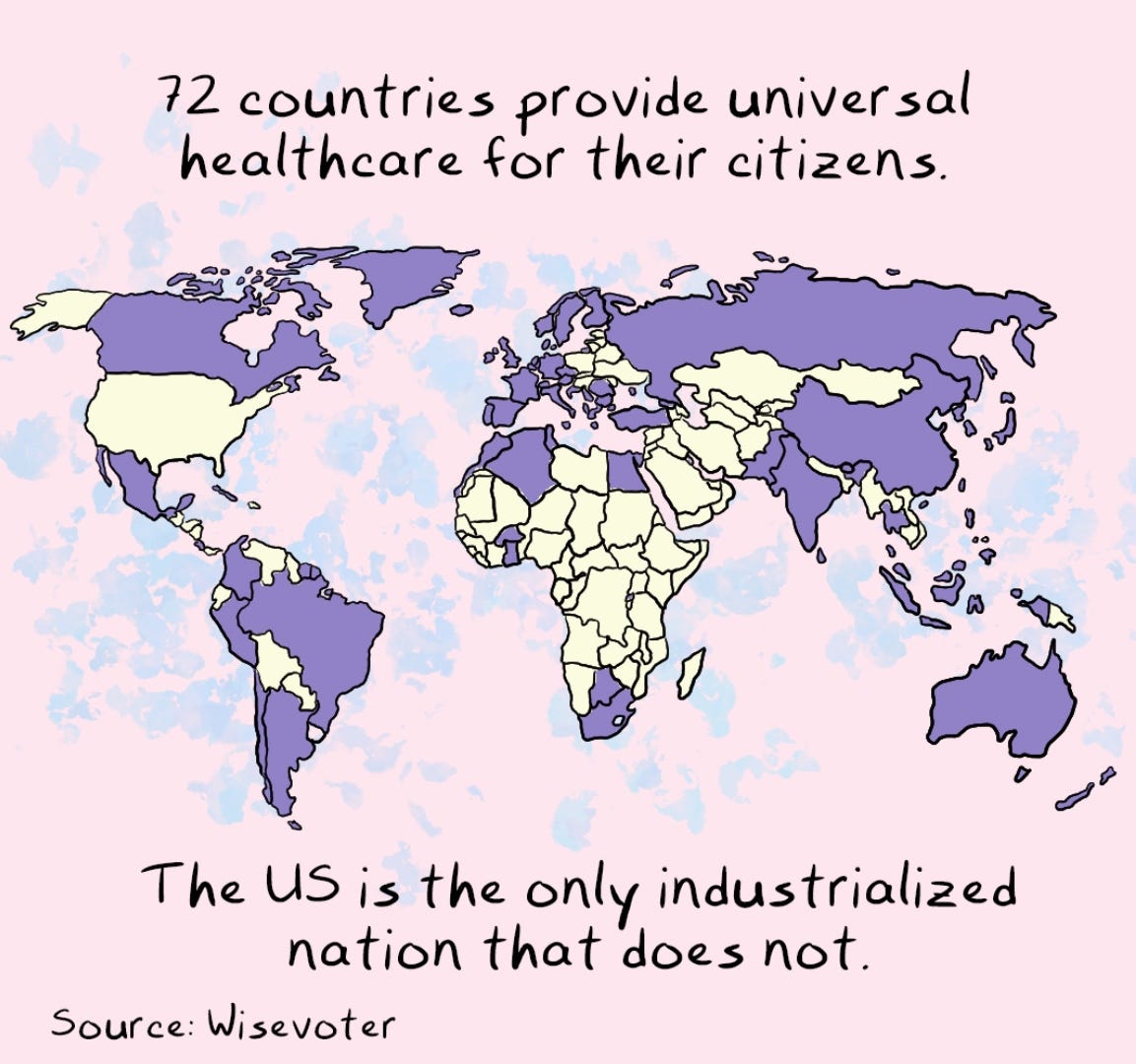

I am dreaming of: free childcare; supplemental childcare payments; supplemental income at poverty level; free college; free healthcare and pharmacy (negating the healthcare insurance scam); ending the internationally embarrassing spectacle of savings-depleting catastrophic medical debt; and a revised, equitable tax code where the rich pay their fair share.

What we now have, well…as we say down home, “It ain’t right.”

Our money was given to them. They hoarded wealth in a publicly funded and protected freedom (like none other). They exploited that, me, and you. Your jobs shipped overseas. Your towns hollowed. I did not even get a bone. My underwear today, made in Vietnam for God’s sake.

The Gall. They secured public funding from Federal contracts. They exploited tax loopholes. Their workers, they screwed by shipping millions of their jobs overseas. Then, they shut U.S. manufacturing plants and all U.S. chip fabs.

They abused trickle down tax cuts to fund shipping their manufacturing jobs overseas. That is opposite of their covenant with voters. They abused our roads and bridges with their truck fleets, causing way more damage than my one car. Instead of revitalizing it periodically to make it more efficient (like Japan and Germany) they left us a jobless Rust Belt, the very core of our Industrial Revolution infrastructure that built the country. Our furniture industry in North Carolina, similarly gone. Thanks for that. The gall.

They have never paid their fair share. In 2017, Trump cut the top individual income tax rate from 39.6% to 37%. He cut taxes on corporations from 35% to 21%. He added $2 trillion to our debt because there was no trickle down. The benefits and tax cuts of the largest free economy in the world enriched them. After breaching their contract with American workers, they skidaddled with all their tax-cut money. Of trickle down, you never saw a drop.

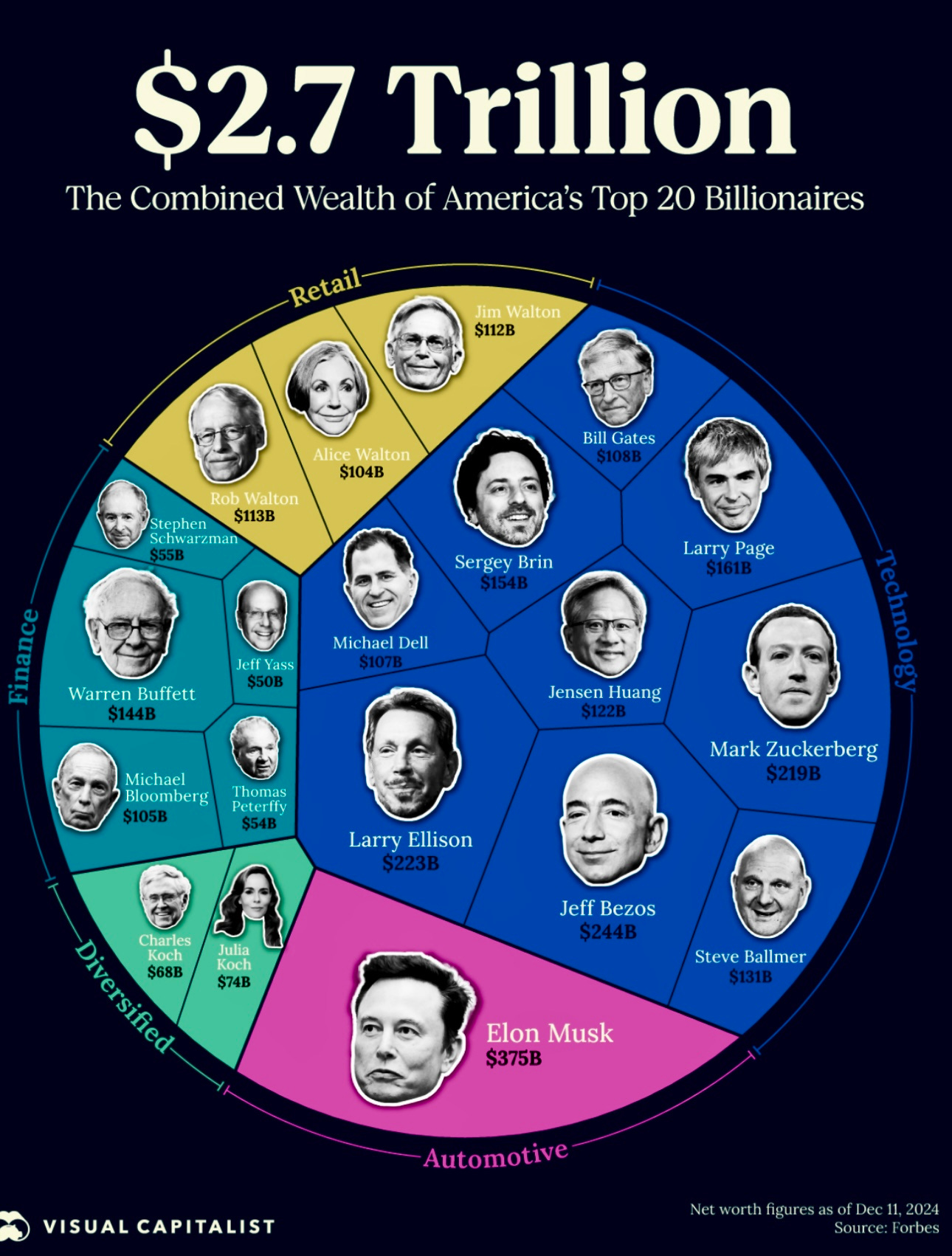

Overall that latest 2017 tax cut was skewed to the rich. Households with incomes in the top 1% will receive an average tax cut of more than $61,000 in 2025, compared to an average tax cut of less than $400 for households in the bottom 10%, according to the Tax Policy Center.

Does this tax cut look skewed to the Right to you? On after-tax income, tax cuts at the top—for households in the top 5%—are more than 12 times the total COMBINED value of the tax cuts received for all other people with incomes in the bottom 5 categories (95%).

Hear me roar!

The top billionaires pay less than 8.3%. Unconscionably, that is below the 12% tax rate paid by a poverty-level family of 4 with $30,000 income. This is criminal.

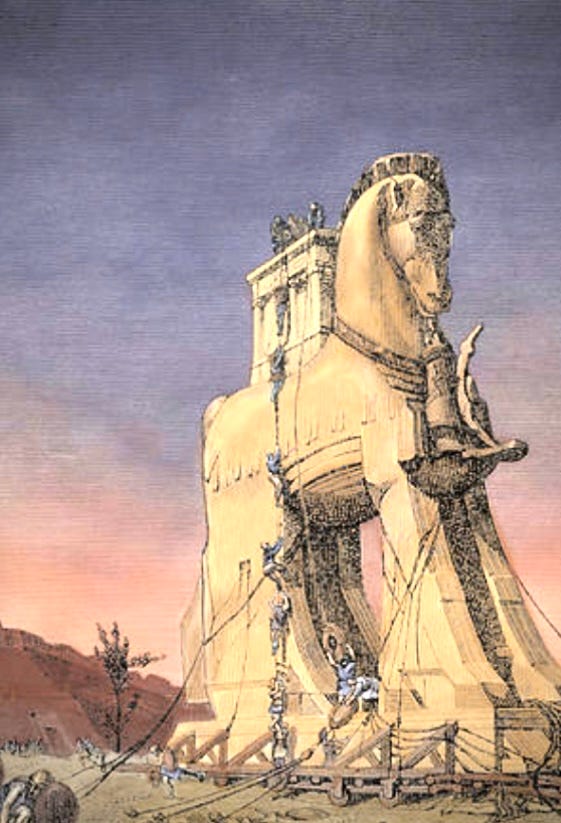

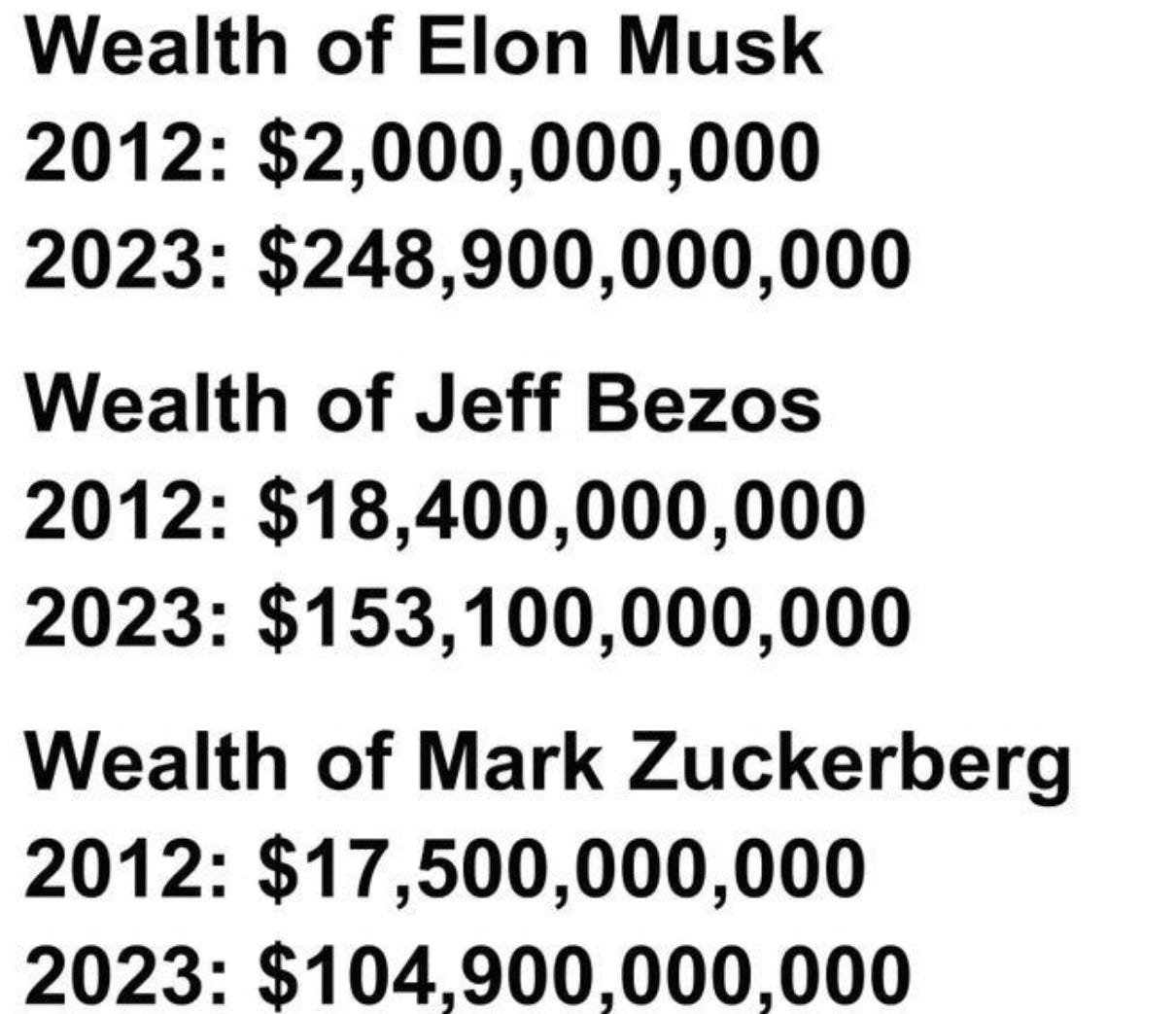

Consider the most wealthys’ income GROWTH over the last decade+. It looks like this with exceedingly low tax rates and a tax cut!

Now, consider their gifts to the poor.

Why? Doesn’t your butt hurt? Mine does. The 2017 Trump tax cut, promised to grow the company and pan out, added $2 trillion to the next decade’s Federal deficit because trickle down did not and never has worked. The 2017 tax law’s benefit-tilt to the top reflects several costly and somewhat unnoticed provisions that primarily benefit the most well-off:

Large, permanent corporate tax cuts. The centerpiece of the law was a deep, permanent cut in the corporate tax rate — from 35% to 21%—and a shift toward a territorial tax system, which exempts certain foreign income of multinational corporations from tax.

20% deduction for pass-through income. The law adopted a new 20% deduction for certain income that owners of pass-through businesses (partnerships, S corporations, and sole proprietorships) report on their individual tax returns, which previously was generally taxed at the same rates as wage and salary income.

Cutting individual income tax rates for those at the top. The law cut the top individual income tax rate from 39.6% to 37% for married couples with over $600,000 in taxable income (and often even higher gross income), and

Weakening the alternative minimum tax (AMT). The law also dramatically weakened the AMT, which was designed to ensure that higher-income people who take large amounts of deductions and other tax breaks pay at least a minimum level of tax. The revised law made far fewer households subject to the AMT and typically made those still subject to the provision pay far less, delivering another sizable tax cut to many affluent households.

Doubling the estate tax exemption. The law doubled the amount that the wealthiest households can pass on tax-free to their heirs, from $11 million per married couple to $22 million (indexed for inflation). Why?

Wealthy Individuals. Here’s what we know:

U.S. billionaires are 46%, or $1.6 trillion, richer than they were in 2020.

According to a 2021 White House study, the wealthiest 400 billionaire families in the U.S. paid an average Federal individual tax rate of just 8.2%. For comparison, the average American taxpayer in the same year paid 13%.

According to leaked tax returns highlighted in a ProPublica investigation, the 25 richest Americans paid from 2014 to 2018 a “true” tax rate of 3.4% ($13.6 in taxes on income of $401 billion).

Is this fair and equitable? Not on your life. It ain’t right, I keep telling you. Now Trump suggests further tax cuts for the rich. He will try. We will fight it. I say raise their taxes to 70% to be fair and equitable. Now.

Corporations. While the big companies have had record profits, most enjoy lower tax rates than most working families. I can live with that; however, many profitable corporations pay no U.S. income tax. I will not live with that.

CBO said “Statutory rate reductions for individuals were relatively small compared with the corporate rate reduction.” If the tax cuts were intended to be a middle-class tax-relief plan, it was the least competently drafted bill in history. It was in fact fraud, because material misrepresentation is fraud.

The wealthy’s most lucrative (and perfectly legal) tax avoidance strategies include accelerated depreciation, the offshoring of profits, generous deductions for appreciated employee stock options, and tax credits.

Here’s what we know:

According to the Institute on Taxation and Economic Policy, at least 55 of the largest corporations in America paid no Federal corporate income taxes in 2020.

The U.S. Government is estimated to have lost around $135 billion in revenue due to corporate tax avoidance in 2017.

Corporations shifted nearly $1 trillion in global profits to tax havens in 2022—depriving countries all over the world of desperately needed tax revenue.

That is not paying a fair share. How could you have let this happen? (Yes, you!) I like pointing out you did this. (But, okay, I did it. We all did it.)

Does this look right to you?

I can’t raise taxes on the wealthy now. We can propose it inside Potential at midterms (along with free education through college, universal healthcare and pharmacy, and free childcare, etc.) These are things I already put into Potential. These things will sell to ALL Americans. Further, calculations from Oxfam found that a progressive wealth tax on US multi-millionaires and billionaires could generate $664 billion dollars every year to help lift people out of poverty. Income tax increases on the wealthy could further bolster the U.S. Treasury.

Frankly, we made this mess working the scam of two Santa’s. We need to clean it up. Clean up what again? The scam of 2 Santa’s. Here is an excerpt to explain from The Hartman Report.

This is the classic Two Santas’ strategy that the GOP has been running ever since 1981. In addition to showing the hypocrisy and depravity of these politicians who are happy to live on the largesse of rightwing billionaires but see no benefit in feeding hungry children, it also shows that Jude Wanniski’s grand plan, adopted by Reagan in 1981, is alive and well.

It’s no accident or coincidence that the threat of a failure to pay the nation’s bills or fund an upcoming year constantly happens when Republicans control the House of Representatives.

You could even call it a conspiracy: there’s an amazing backstory — with a unique name — here. And it all started with a guy named Jude Wanniski, who literally transformed Republican Party politics with a plan that the American mainstream media, astonishingly, continues to ignore.

Here’s how it works, laid it out in simple summary:

To set up its foundation, Wanniski’s “Two Santas” strategy dictates, when Republicans control the White House they must spend money like a drunken Santa and cut taxes on the rich, all to intentionally run up the US debt as far and as fast as possible.

They started this during the Reagan presidency and tripled down on it during the presidencies of Bush and Trump with massive tax cuts for billionaires and increases in spending across-the-board.

Those massive tax cuts and that uncontrolled spending during four Republican presidencies produced three results:

They stimulated the economy with a sort of sugar high, making people think that the GOP can produce a good economy;

They raised the national debt dramatically (it’s at $36 trillion today, all of which tracks back to Reagan’s, Bush Jr.’s, and Trump’s massive tax cuts and Bush’s two illegal off-the-books wars);

And they made people think that Republicans are the “tax-cut Santa Clauses.”

Then comes part two of the one-two punch: when a Democrat is in the White House, Republicans must scream about the national debt as loudly and frantically as possible, freaking out about how “our children will have to pay for it!” and “you must cut spending to solve the crisis!”

The “debt crisis,” that is, that they themselves created with their massive tax cuts and wild spending.

Do whatever it takes, the “Two Santas” strategy goes. Tie up legislation, deny a quorum, filibuster, shut down the government, whatever.

Which is why, following Wanniski’s script, Republicans were squealing about the national debt and saying they will refuse to fund the government, possibly crashing the US economy on Biden’s watch.

And, once again, the media covered it as a “Debt Crisis!” rather than what it really is: a cynical political and media strategy devised by Republicans in the 1970s, fine-tuned in the 1980s, and since then rolled out every time a Democrat is in the White House.

Politically, it’s a brilliant strategy that was hatched by a fellow most people have never heard of: Jude Wanniski.

Republican strategist Wanniski first proposed his Two Santa Clauses strategy in The Wall Street Journal in 1974.”

Kill Loopholes; Raise the Wealthy’s Rates. I hope to tax individuals and corporations at higher rates with no loopholes. I never want to see a mess like this again. I don’t need loopholes. No one does. I think our current tax code is criminal. We need to tax the wealthy fairly. Eisenhower said 91%. Potential is holding at 70% tops.

Corporations, we cannot take them much higher, but loopholes can go. The impact on employment would hurt. Senators Elizabeth Warren and Katie Porter will figure it out for us in the end. We are just building a potent strawman with which they will be enticed to start unpacking our Potential.

What can we do with new income? Lots.

End poverty as we know it in the U.S.

End child hunger in America

Treat people as human beings with rights to universal healthcare, public college education, housing, and a truly living wage,

Make unemployment insurance Federal instead of state-run, and

Build Potential. See the Guide: Brainstorm Platform link at the bottom of this post. (Ayoa.com has a sale now on the mind mapping software, and slimmed downed, it is also free.)

Ted Kennedy admonished Democrats at the 1980 national convention not to forget the fight for “the cause of the common man and the common woman.” We then forgot.

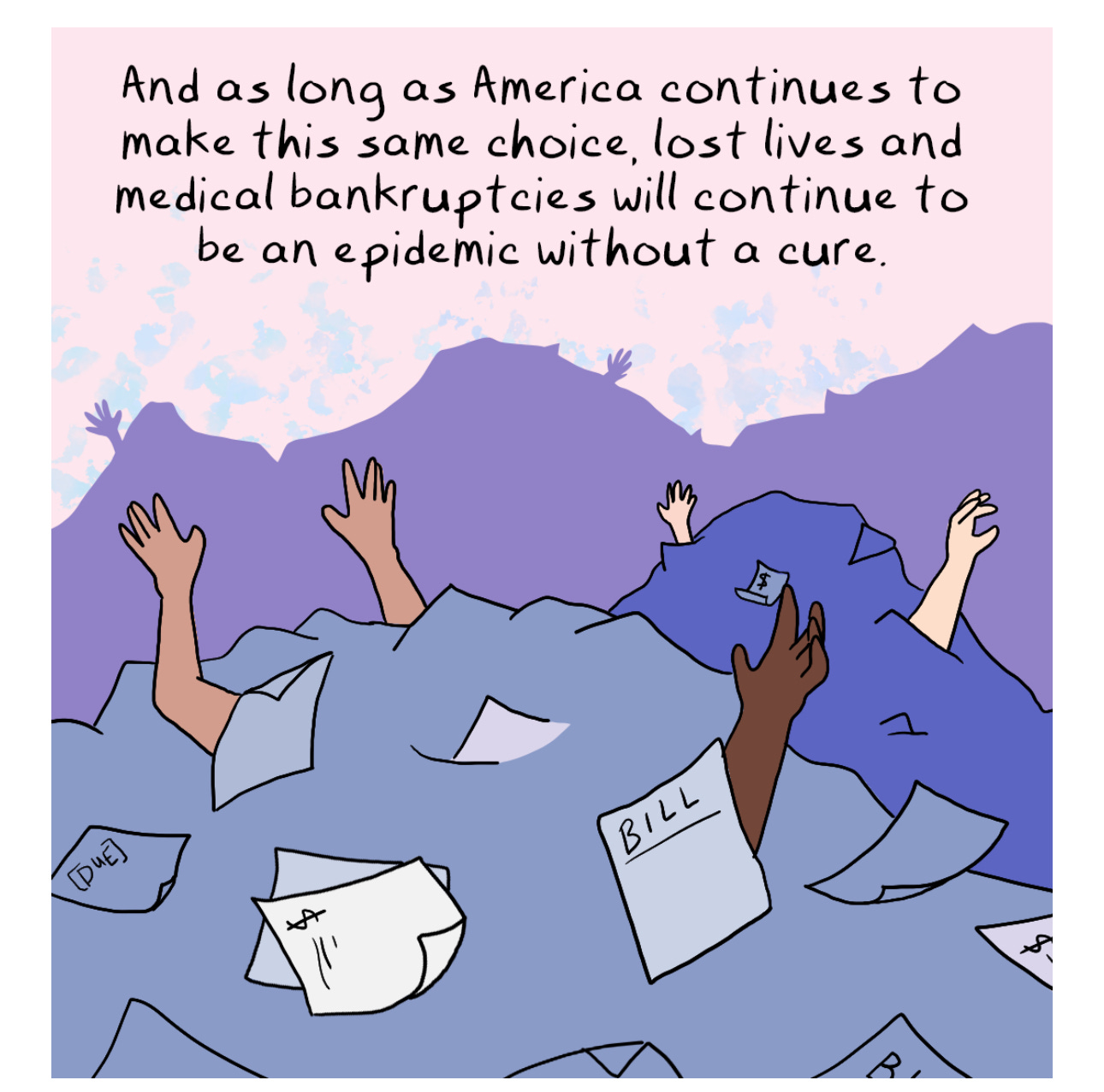

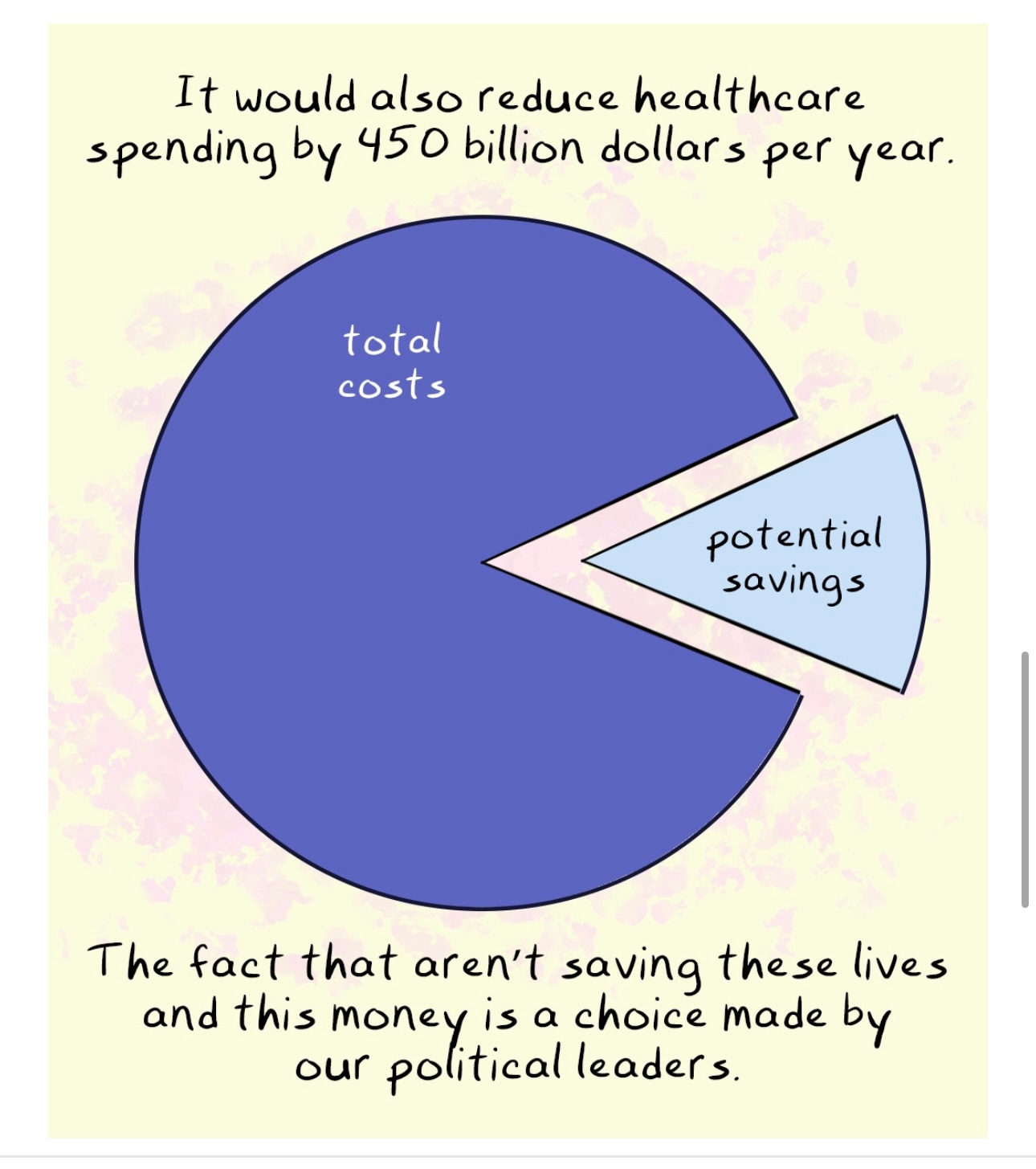

Unforgivably, we have never put the programs we want up for the vote. The primaries scuttle those, like Bernie, that try. It takes courage: we need courage to do that. Will a new leader please stand up and use Potential? Corporations are profiting from letting people die. We cannot go on like this.

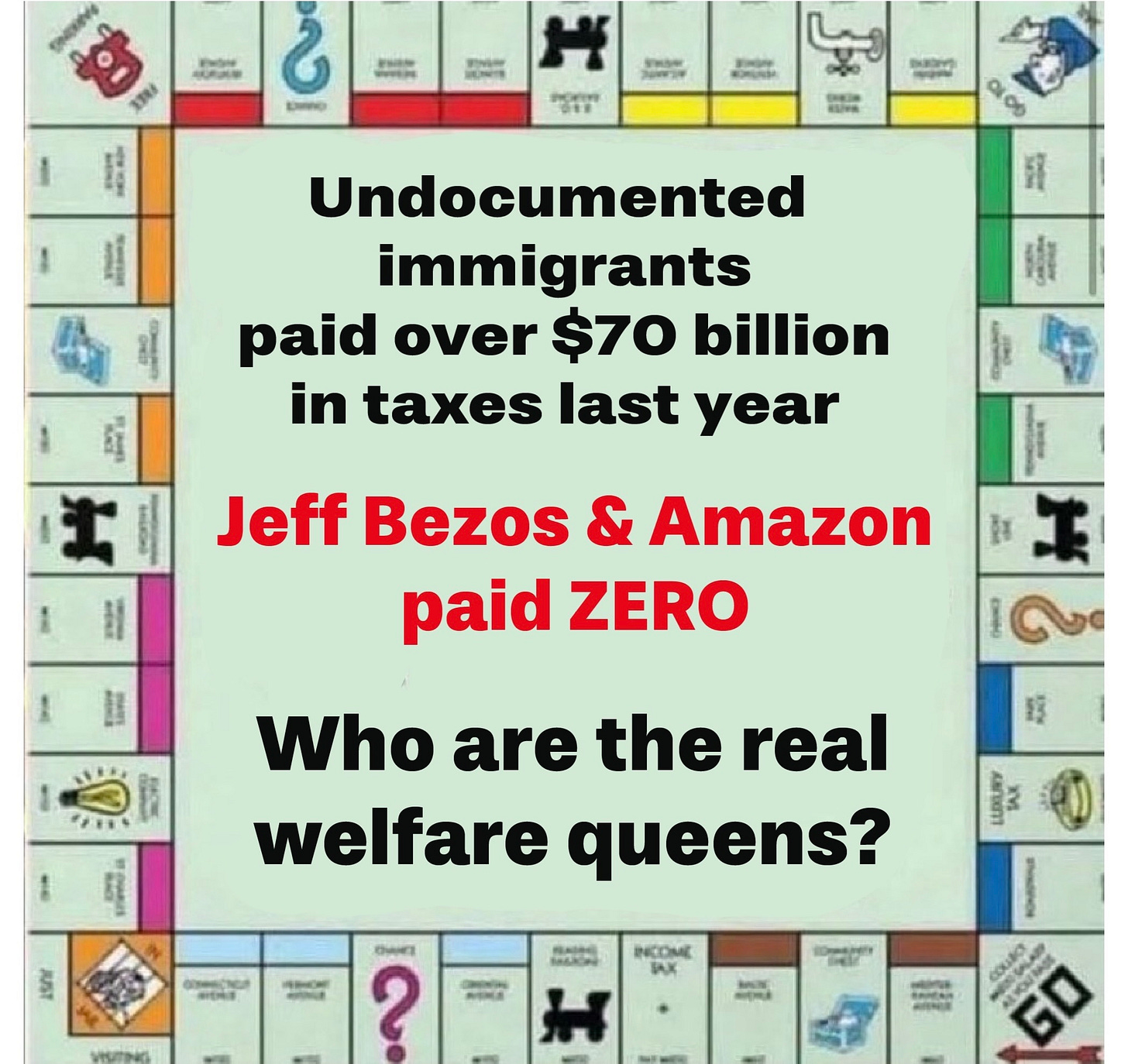

No doubt the health insurance industry has record profits because it has prioritized their profits over their reputations. This rip off is criminal misconduct.

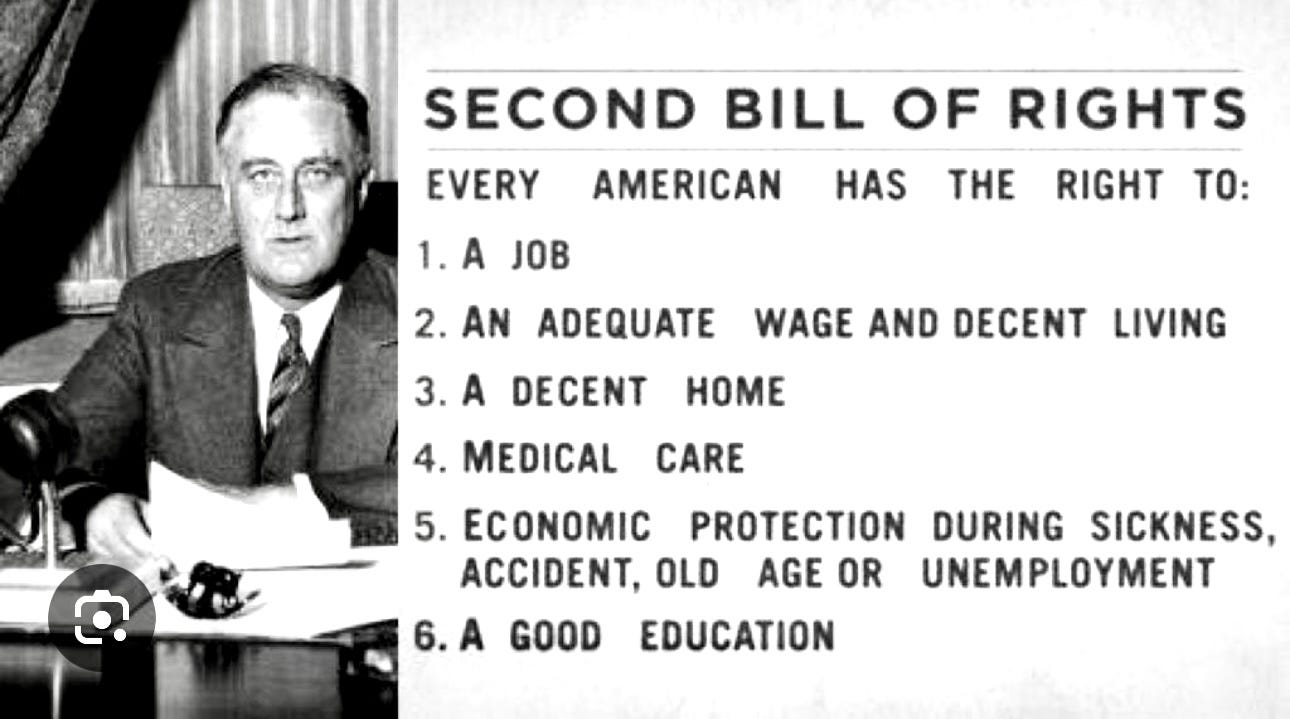

We could have chosen to fix this long ago. How long ago? How about 1944ish.

FDR gave us a list of 6 things. Human rights things. Let me say also that a list in a mind map may be but 6 items. I have done brainstorming by mind mapping for 25 years.

FDR’s list of 6 things, we decline even to debate it. Because we might be called socialists? Give me a break, people. Children are going hungry. People are dying on our watch from healthcare too costly. People are going homeless.

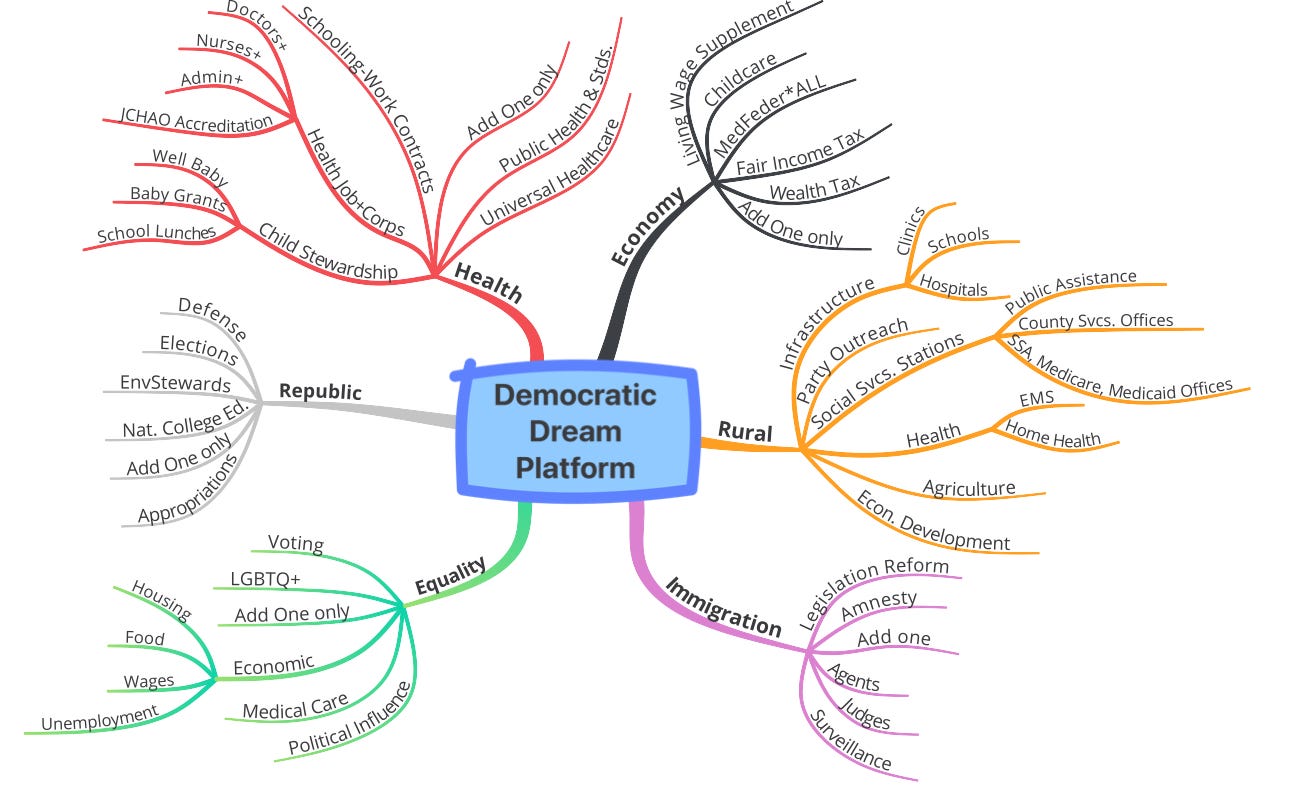

If we put what we want and need in the Democratic Platform, the platform becomes a national referendum with Potential. I say do it. Heck, I did it by myself. See.

Mind Map of the Democratic Dream Platform. The main legs are only the beginning.

Don’t look at the content too closely. One brain and its 10 billion brain cells is not the way to mind map. Give me a group of 10-20 issue knowledgeable people (100 to 200 billion braincells) and you will get an extraordinary mind map from brainstorming with them.

At least give me a shot at voting for it, please. Let the people speak, debate, and vote. Yes, vote. Is that too much to ask? We have always had a choice to go all in for FDR’s mandate for any election, but we have always declined. There would be too much debate about it? What?

Of all bankruptcies, 72% are related to catastrophic medical debt. I do not fear the debate of the healthcare system and the tax code because we have the data. Ours is also a code of our morals and integrity, a higher moral ideal than the carnage wrought by dark money that we now endure.

The healthcare system and the tax code are broken beyond repair—near criminal. We lag behind other countries. We are mired in political donations (kickbacks) to politicians. And for those kickback donations, those compromised vote for the goals of their wealthy donors at the expense, the livelihood, and indeed the life of the people. Quid pro—deadly—quo. Time to fix this. How? Talk loud! Talk stout! About what you know about!

Thank you for the excellent analysis! Powerful charts! One further point to make. Biden passed a law in 2024 to beef up IRS funding. According to a revised estimate by the Biden administration, a funding and staffing surge at the IRS could lead to as much as $850 billion in new revenue over the next decade. But now tRump wants to gut the IRS. You may already be following them, but another tax-the-billionaires champion is Patriotic Millionaires. @patrioticmillionaires.org. They wrote "Pay the People" https://shorturl.at/SkPNd.

🎯🎯 Bravo. Spot on. Essay so important, substantive, clear, concise, organized. This will help me to talk with/teach/explain more succinctly than I have been.