Musk’s Speciality: Cooked Books

Stock tanked. Bank loans at risk. What else can a billionaire do?

I cannot believe Elon referring to Tim Walz as a jerk. Tim’s actions included holding a graph of the Tesla stock price drop. Elon does not see his own complicity in tanking his own stock. The jerk that tanked the Tesla stock was Elon Musk!

Totally unaware he is now reviled for his narcissistic cruelty, Musk blew $27 million trying to buy unsuccessfully an election in Wisconsin. His personal stock has also tanked.

Elon Musk has been caught cooking the company books multiple times. One year, three of his chief accountants quit. The Robotaxi escapade years back (2018-2019) is most notable. Tesla reached scale production of Model 3 in 2018, leading to huge Model 3 sales as it worked through pre-sale backlog. This was an article at the time:

-But by 2019, production capacity outstripped domestic demand, leaving Tesla with excess Model 3s it needed to sell - so it started exporting Fremont production despite its own overseas factories already under construction

-During this period, two CAOs one CFO and several GCs were replaced and Tesla restated its financials based on revised revenue recognition relating to lease sales. Red flags abound.

-Under new accounting, Tesla could recognize lease sales as regular revenue so long as the expected future fair market value (determined by Tesla) exceeded the guaranteed buyback price.

-But looking closer at the description of these new leases, it was tailor made to overestimate sales via financing agreements (repos) with offshore entities.

-Only problem is that cars depreciate. In a repo, you pay a higher price at the end of the term than you receive in initially, therefore any sales would have to be written off as the counterparty's "put" money - indeed Tesla 1Q2019 wrote off $500M in sales.

-To fix this problem, in 2Q2019 Elon and Tesla make the claim that the Model 3 is an "Appreciating Asset" based on its potential future FSD capabilities, providing public corroboration to underpin its accounting claim it was about to make.

-Setting the stage for Robotaxi Repo. By claiming the Model 3s were appreciating asset, they could recognize 100% of revenue for their excess production, without recognizing any offsetting liability or write downs as the estimated future value would exceed the buyback price.

-Beginning in 2Q2019 Tesla "Other" international revenue mysteriously exploded, as its inventory dramatically shrank. From 2Q-4Q2019 these sales represented 36% of total Tesla revenue. Tesla stopped breaking out this category in 2020.

-We estimate $2.5bn of Robotaxi repos took place over three quarters in 2019. Operating cash flow ex. this amount was negative. FCF was -$2.5bn vs $0.0bn as reported. This could have included up to about 100k cars or likely 10%-30% of 2019 deliveries depending on sales price.

-All Teslas key metrics rebounded substantially from 1Q2019 and have remained strong going forward.

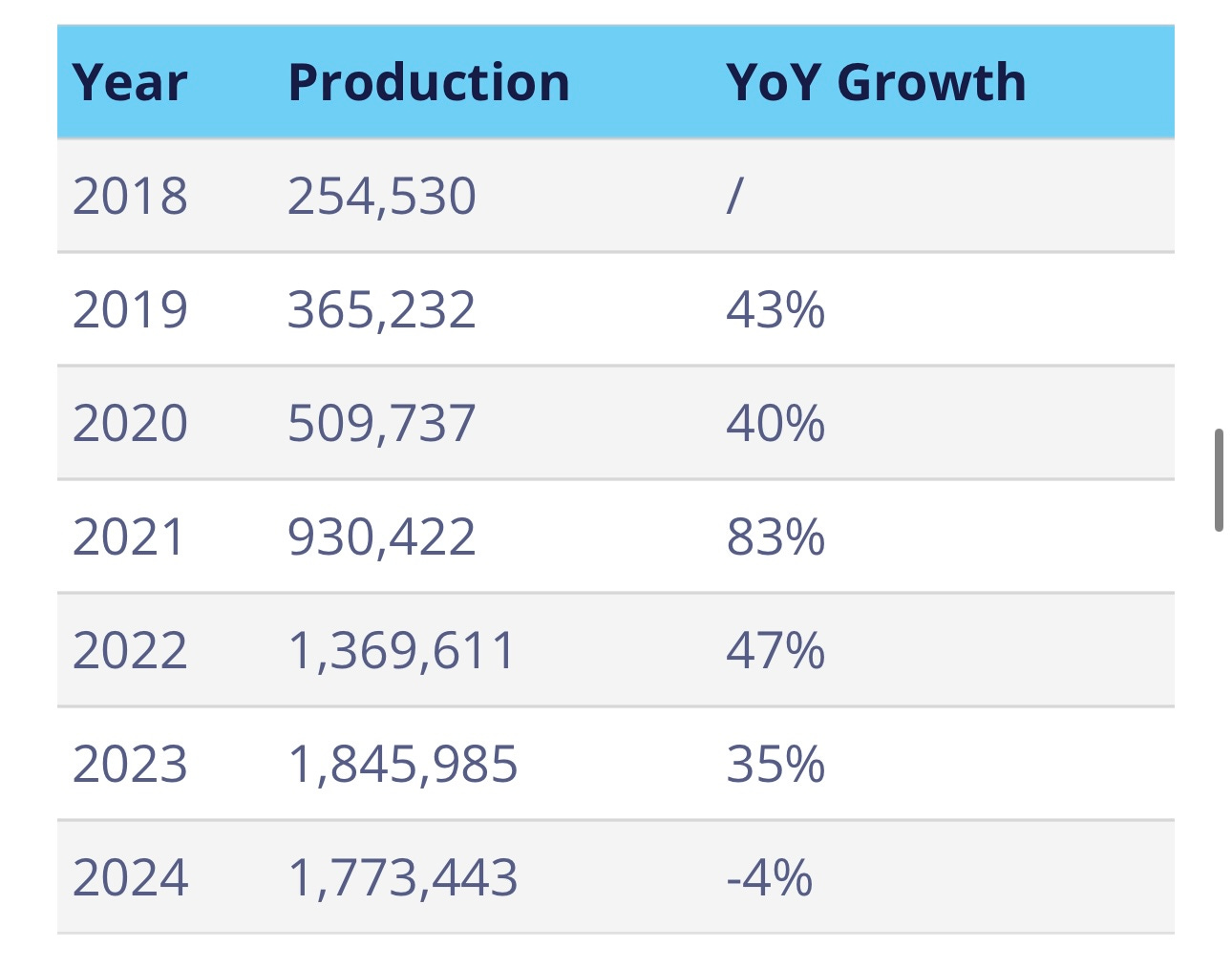

Musk has good reason to cook the books again. Loans will be called if really bad numbers are made public. Previous sales are in the chart.

Unsold production capacity clogs the logistics network and backs up inventory on company car lots.

U.S. and China sales are the bulk of Tesla sales, and 67% would be my guess. Revenue from China however is much less per unit, approximately 60% of the cost of a U.S. built model.

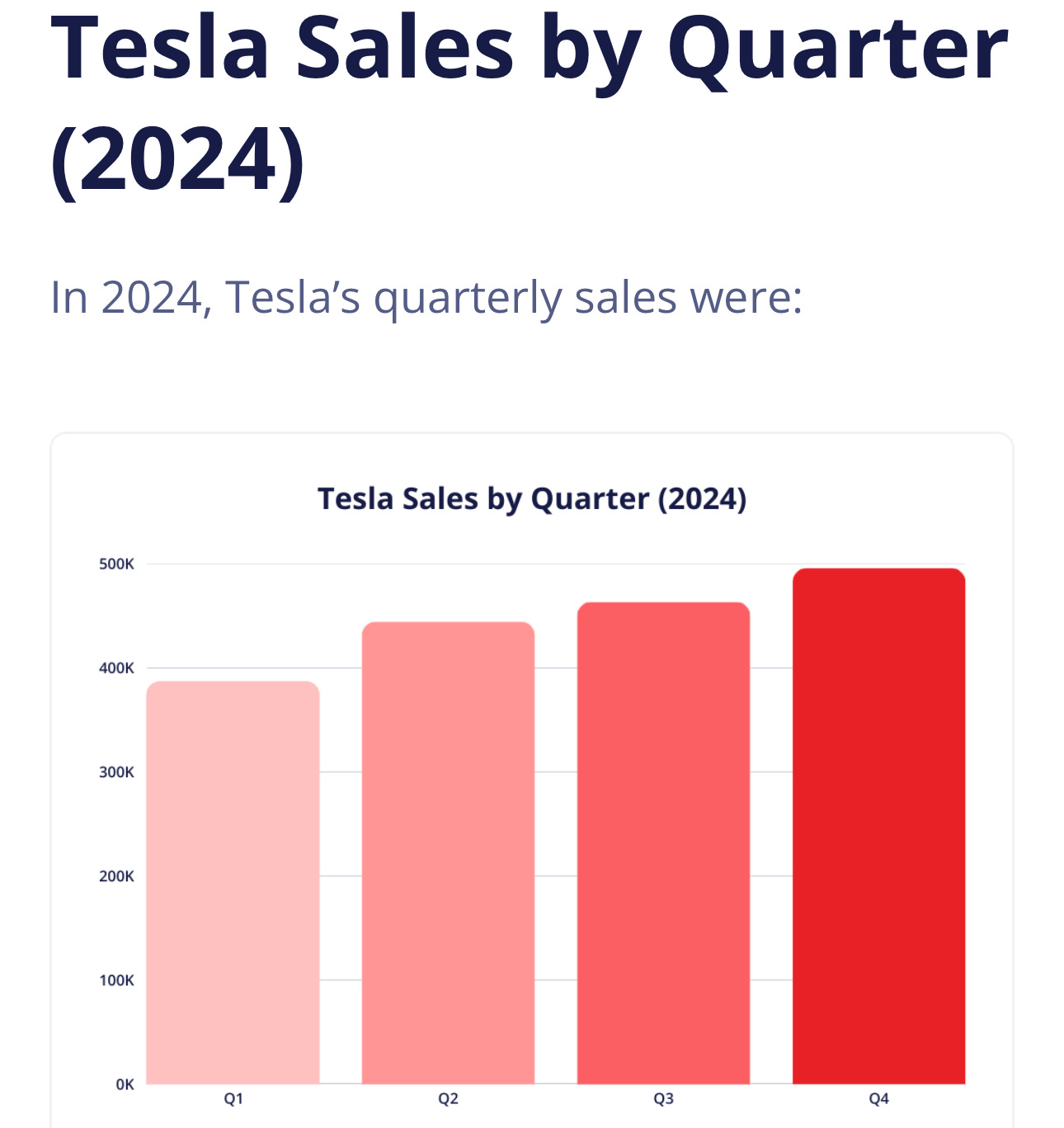

I think the Tesla Q1 sales numbers reported to be 336,000 are overstated. I believe the real number for Q1 will be 250,000.

The early data from countries that already reported their March numbers is not looking good:

France reports 3,159 Tesla deliveries in March – down 37% from March 2024 and down 41%i n Q1

Netherlands reports 1,536 Tesla deliveries in March – down 61% from March 2024 and down 50% in Q1

Sweden reports 911 Tesla deliveries in March – down 64% from March 2024 and down 55% in Q1

Austria reports 815 Tesla deliveries in March – down 34% from March 2024 and down 48% in Q1

Switzerland: -65% YoY in Q1, only 1195 Teslas registered in first three months of 2025.

Belgium reports 958 cars in March 2025 vs 3121 last year March. That is a whopping decline - 69.3%. Over the quarter, we see a drop of 58.18%.

Portugal reports 1,209 Tesla deliveries in March – up 2% from March 2024 but down 26% in Q1

Norway reports 2,211 Tesla deliveries in March – down 1% from March 2024 and down 25% in Q1

Germany Reports that Tesla sold 2,229 cars in March, down 42.5% from year earlier. The number of Teslas sold between January and March 2025 dropped 62.2% to 4,935 units, compared with the same period last year..

While Tesla started deliveries of the new Model Y and benefited from a few weeks of orders in March, it hasn’t delivered the new RWD version of the updated Model Y, which should help sales to a certain degree.

The question is how much help and for how long.

I interrupt this program for a commercial break. Please subscribe if you have not done so. Go paid if you can, but free if you like. Comment too, please.

In China, where all versions of the new Model Y are already available, Tesla introduced incentives to lift sales. That incentive is 0% interest.

Tesla sold 78,828 electric vehicles in China in March, down 11.5% year-on-year, according to data from the China Passenger Car Association (CPCA) released on Wednesday. That is not retail sales data. That is wholesale data, and to me that is not a sale, it is a car shipped. Something is fishy. In 2022, China had accused Tesla of new reporting violations for the Year 2019. Sales were off something like $21 billion.

In 2025 China reported sales by Tesla were 30,688 cars bought in February, but 78,000 in March. Evidently Model Y was 48,000 sales in March. That big jump in March is what I had expected to be a fraud, but I cannot tell. Orders on the Model Y sales in China had been collecting since January. My judgment is there is something fishy in the numbers. It is not looking good to me and we know Musk not to be trustworthy with his accounting. Musk passed on his creative accounting abilities to DOGE.

It does not seem plausible that China sales were off 49% in February and just off 11% in March. I expect shipments, not sales. European sales are off 60% and U.S. sales are off 13%. U.S sales declines as reported are circumspect. I expected a 50% decline, not 13%. I am not buying Tesla’s U.S. sales numbers. The U.S. is where I suspect creative accounting.

I can buy worldwide sales off 50%. Minimum.

I anticipate sales were 250,000 for the first quarter That would be the case if 89,000 forward-booked sales are removed and put back into the second quarter. That sounds more plausible to me, and settles my mind regarding the disconnect of previously reported declining sales numbers and the suspect Q1 sales numbers.

My guess of 250,000 sold in Q1 is a near 50% decline from 4th quarter sales.

Such a number reported by the press would have created a massive sell off on the stock. As it was the stock went up $14 today to $282 but after hours it went down $22. It should open in the morning around $260. It bears watching.

As January and February Tesla unit sales were booked some time ago, all the creative accounting I suspect will be in March reporting. I am not a forensic accountant. Others will have to do the real investigation.

I am also unsettled that Musk “sold” X for $33 billion to his worn company when its worth is reported to be $673 million. Hope you will understand this better than I do. I feel my whiskers tingling. Somebody is getting shafted here. In retail this is akin to not properly marking down inventory. That is fraud on any investor.

https://electrek.co/2025/04/01/teslas-electric-car-sales-decline-deepens-in-europe/

https://fortune.com/2025/03/09/tesla-china-sales-market-share-elon-musk-byd-ev-competition/

The Road Ahead. Trump already asked our military to shoot our citizens on the streets, “Can we shoot them in the legs?”), but the military refused. Now he plans to arrest protestors. You know about how far with this that Trump will go, but no one knows what will unfold. Grab a flashlight, because we are at a dark fork on this American road.

Understanding will become a bridge. We all should have affinity with that need. Thank you for finding my voice. You have given that place and meaning by just being here. That is real, heart-felt sentiment because I am still emotionally that little boy Army brat from Dothan, Alabama. I started first grade there in 1955, (but lived in Japan, Germany, Iran, and all over the U.S.). Please consider becoming a paid subscriber to help grow HotButtons.

This is why I hate accounting. After a while, it's "all Greek to me." This sounds like some of the gymnastics that took down Enron. (Remember them?) We may find out that Elon -- like DJT -- is all smoke & mirrors. I'd LOVE that to happen.

I read something a few days ago about them trying to qualify for some program in Canada that was set to expire by claiming to have sold something like a car every 75 seconds from four dealerships over one fantastic / can't believe it / this is incredible week-end.

Canada ... has questions.

Brilliant