Over-Budget Chaos

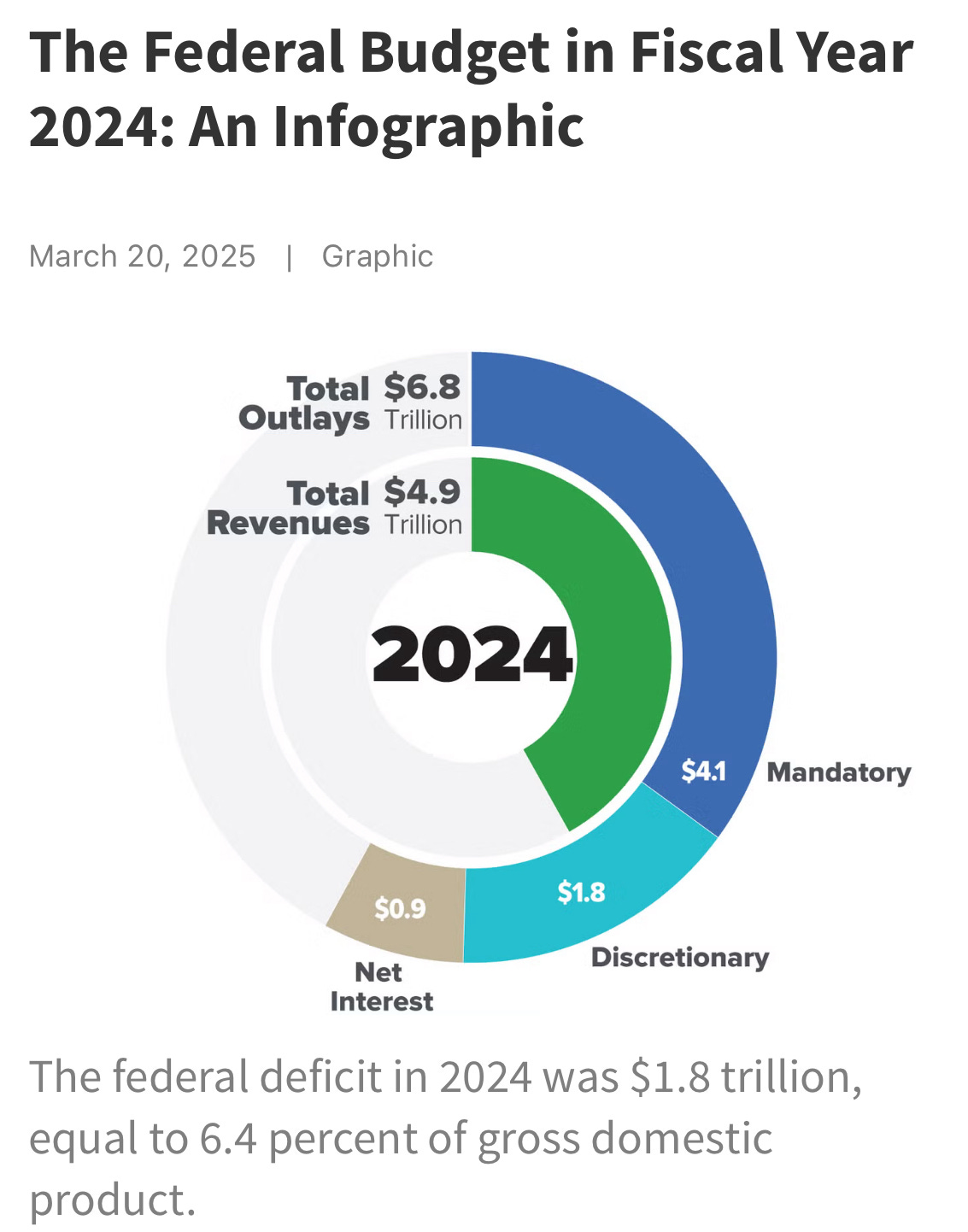

This year’s $1.9 trillion deficit buys us total mayhem. Are you kidding me?

2025’s $1.9 trillion deficit results from the last tax cut in 2017. Studies show the Tax Cut and Jobs Act (TCJA) increased the federal debt and after-tax incomes disproportionately for the wealthy. The TCJA led to an estimated 11% increase in corporate investment, but its effects on economic growth and median wages were smaller than expected and modest at best. In a nutshell, wealth is being hoarded.

The Congressional Budget Office said 2025 will bring us a $1.9 trillion deficit.

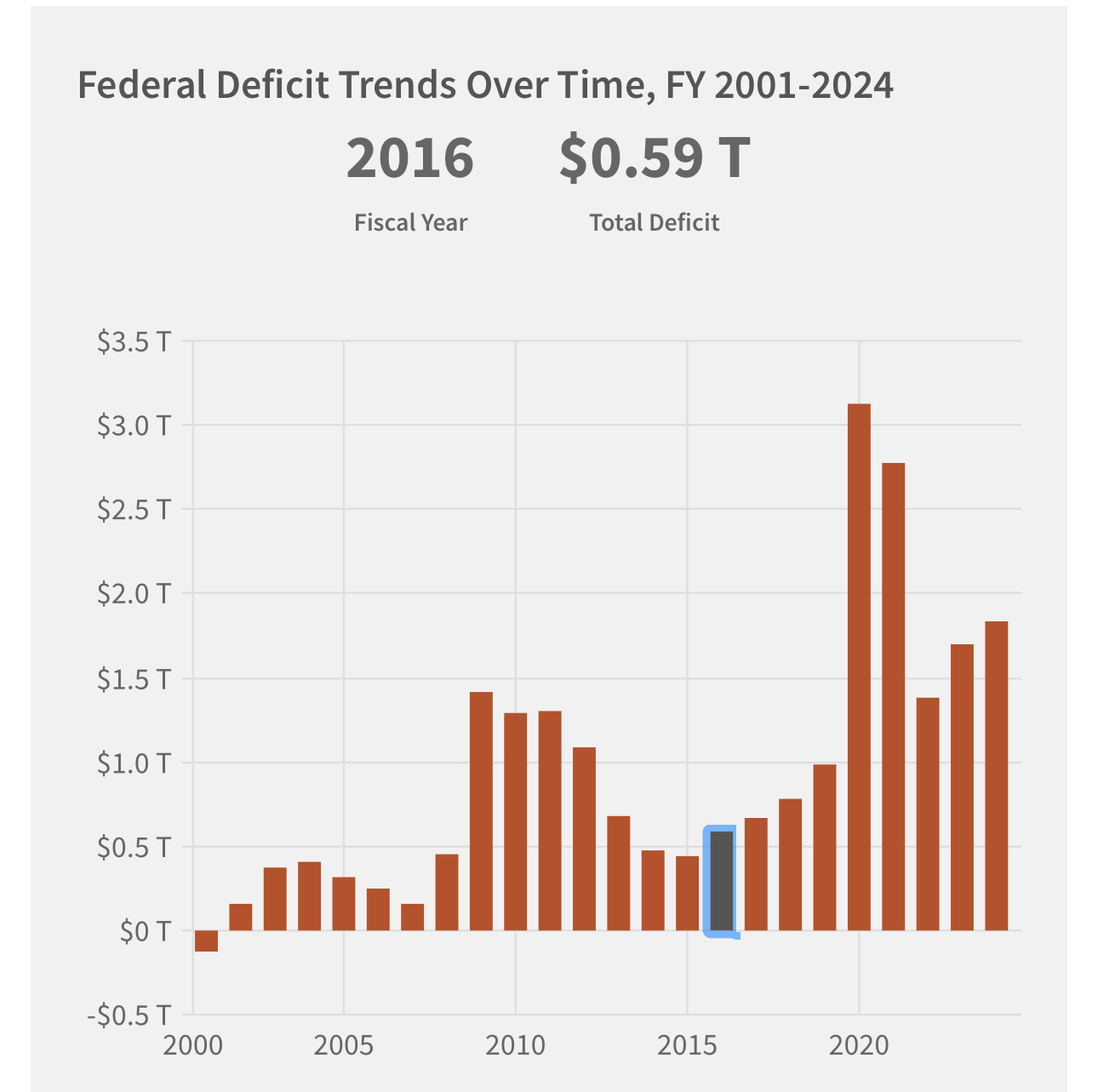

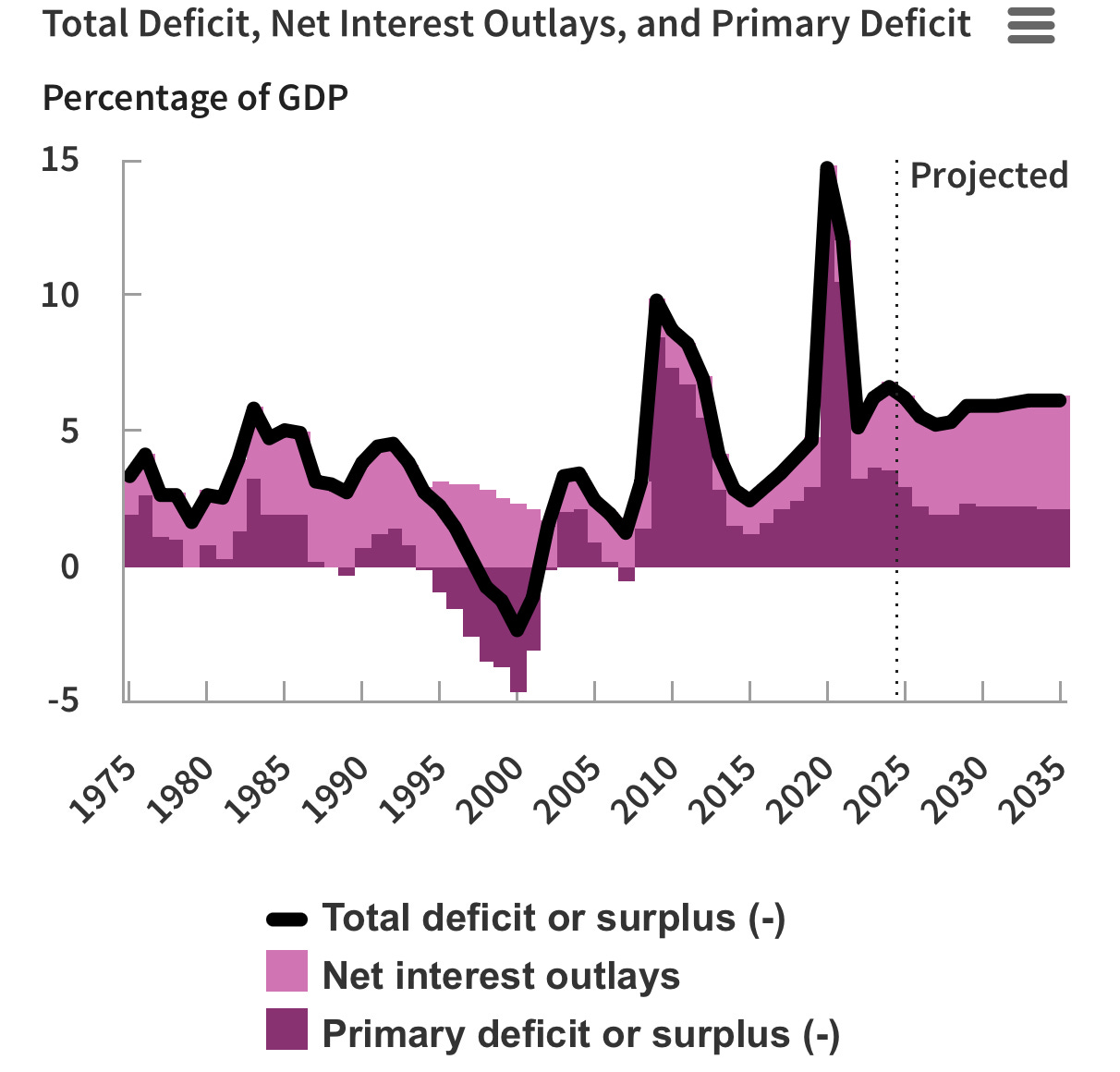

Deficits Are Endemic. We have been in deficits for 25 years straight. Now we are running $1.9 trillion per year in deficits. Where did this begin?

For 25 years we have run deficits. Overcoming unemployment and COVID were huge deficits. President Bill Clinton balanced the budget in 2000. He cut Defense, the sacred cow. HINT!

Over-Budget Chaos. The over-budget chaos we see right now in Congress is exacerbated by the planned additions to the annual budget. The many things Republicans now plan to add are discussed by them…shall I say…lightly.

They discuss only the cuts right now. (Watch the pea, I would suggest.) I further suggest we forget their cuts for the moment as they are not nailed down. Stop playing their mind game. Look only at their new additions for a moment. The reason to take this side road is to keep it simple. The ANNUAL additions they plan are huge, and we need to see how tall Mount Everest is before we melt some of the ice. These are some of the annual addition plans.

• Add $150 billion for Defense

• Add $60 billion for Immigration Hardball

• Add $50 billion for a farmer bailout (My add.)

• Add $10 billion tax cut of tips and overtime (discounted 90% as it will not fly)

• Add $450 billion to extend the TCJA.

My Add. The farmers second bailout. Looming is a farm aid bill not yet on anyone’s radar screen. They have not mentioned that. (I would hide that too!) During the previous Trump Administration this farmer bailout had gotten to $32 billion per year. Lawmakers were calling for adding as much as $50 billion to Agriculture Secretary Sonny Perdue’s arsenal in a coming stimulus package to help producers stung by supply chain disruptions and China’s boycott. I would suggest this $50 billion a year be factored into the 10-year budget, and I have added it.

As shown above, they begin with $720 billion in annual added deficit spending, or $7.2 trillion added over 10 years.

We currently run a $1.9 trillion deficit annually. Figure that is $19 trillion over 10 years. Now add the new $7.2 trillion. That would be $26.2 trillion added to our current $33 trillion deficit. Think $60 trillion in 2036 vs $33 trillion today. Before any cuts, the deficit will be $60 trillion.

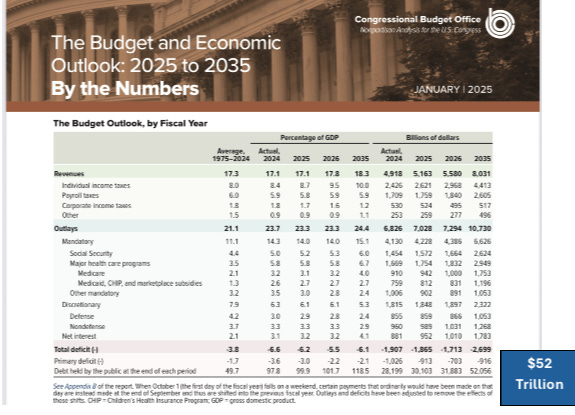

The Congressional Budget Office says it will be $52 trillion. I DON’T THINK SO! (And I explain why!)

The CBO projects growth of the deficit to $52 trillion over 10 years. Their basic assumptions do not hold water. They overlook key problems and wish away interest rate and inflation increases for a decade. My pinball wizard cried “Tilt”. I cry “Foul”.

Where savings come from, though, is a problem that will bedevil Republicans who will try to fulfill their promise to slash spending without hurting or angering their own constituents. The Medicaid Expansion cut will be huge for each Congressional District. Think $2 billion each over the decade.

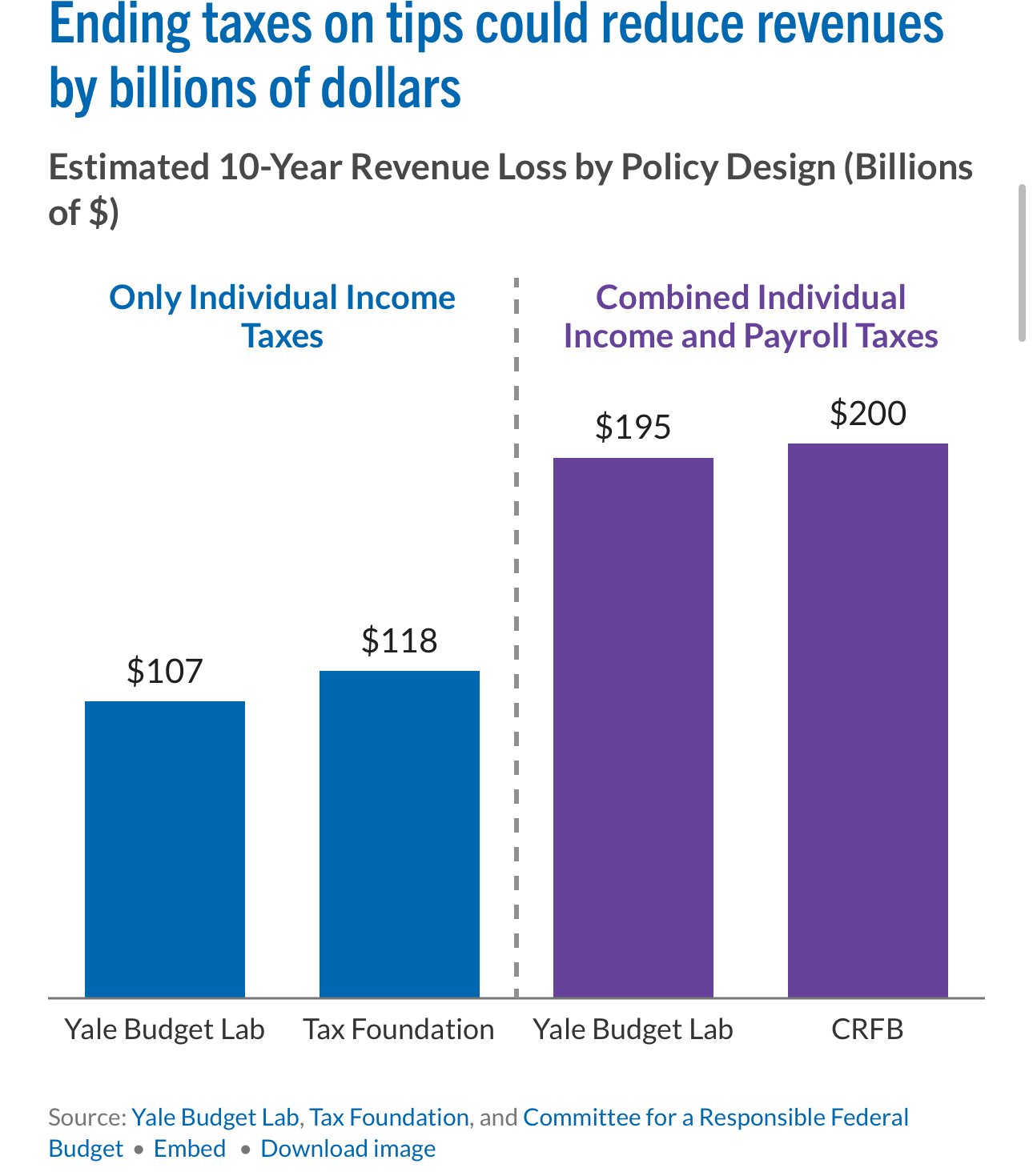

They also want to ensure that the tax cuts for the wealthy passed during the first Trump administration don’t lapse next year. Preserving those TCJA tax cuts alone is set to cost $4.6 trillion over the next 10 years. That doesn’t include Trump’s ideas to end taxes on tips and overtime pay. (The math-centric among you are likely to see that $26 trillion in new costs is more than the highly unlikely $15 trillion in budget reductions sought.) It is unlikely they will be able to come up with any reductions. That will not stop them from sleight of hand and outright lying—just like with the TCJA. There were no jobs, by the way.

The Planned Budget Cuts. Well…that is a secret. None of the initial plans for specific tax cuts being bandied about are locked in. That is either malfeasance, or crooked behavior. (You choose.) Nevertheless, this tax cut will be a slapdash, late-at-night fiasco for them to approve their new budget. They have been using Nancy Pelosi’s budget for years now. They lack the ability to govern.

Medicaid. The House Energy and Commerce Committee is eyeing Medicaid spending as a potential for slashing to hit its goal of $880 billion in savings over the next decade. That could involve revoking state Medicaid expansions, which would potentially reduce healthcare coverage for 15.9 million people. They don’t care. On average, each congressional district would lose $2 billion in federal funding over 9 years. Kiss rural hospitals goodbye.

SNAP. Another option includes major reductions in food assistance under the Supplemental Nutrition Assistance Program (SNAP), which falls under the House Agriculture Committee’s purview. Again, they don’t care. Yes, they will take food from babies to get their tax cut for the wealthy. The American people care and will not let them.

This tax cut business is all a secret now. So they must come up with these new budget cuts. They said like about an annual $1.5 trillion ($15 trillion over 10 years). Then they want to cut revenue with a tax cut. Cut revenue? Won’t that add to the deficit? I THINK SO!

Sure, let us cut Treasury revenue over a decade. Let’s project wage increases and interest rate decreases in the face of recession caused by tariffs. Let’s give corporations a free ride so they can sponsor Republican candidates with dark money.

It is crazy to increase our deficit by 50% and then ask for a tax cut. That tax cut has to be added to that deficit. Sure. I get it. This is what they are doing. Same as the 2017 TCJA: a 100% deficit-funded tax cut.

The wealthy get a tax break benefit that your children and grandchildren must pay back.

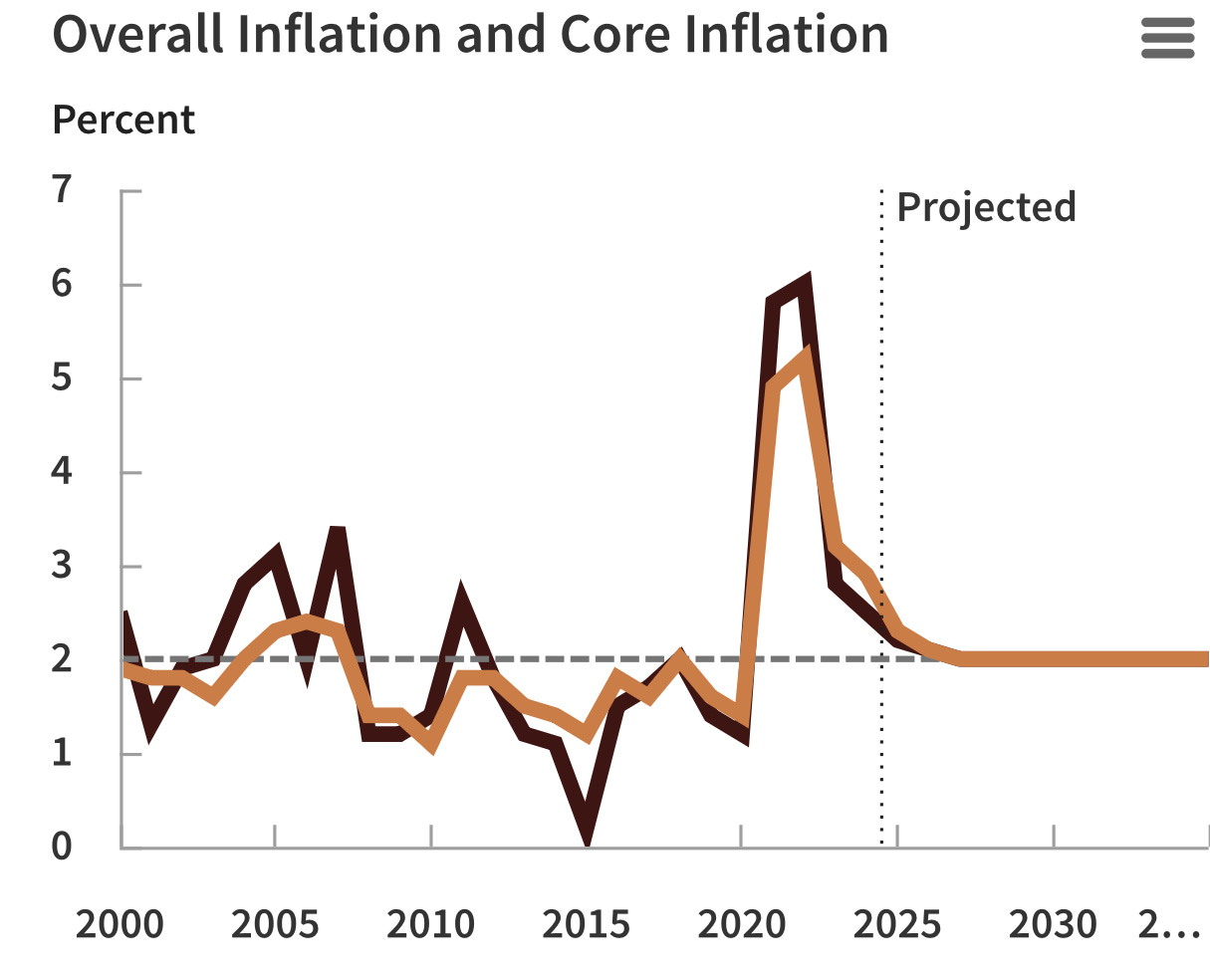

CBO projections overlook the coming recession caused by tariffs and their price increases on consumers. Inflation is now going up. It will go to 5% is my estimate now.

Rising Inflation. The first half of the chart above makes a liar of the second half. I know what the goal is. Plotting the achievement of the goal is not that for which we pay CBO. Tariffs of 10-145% with no inflation forecast? Come on.

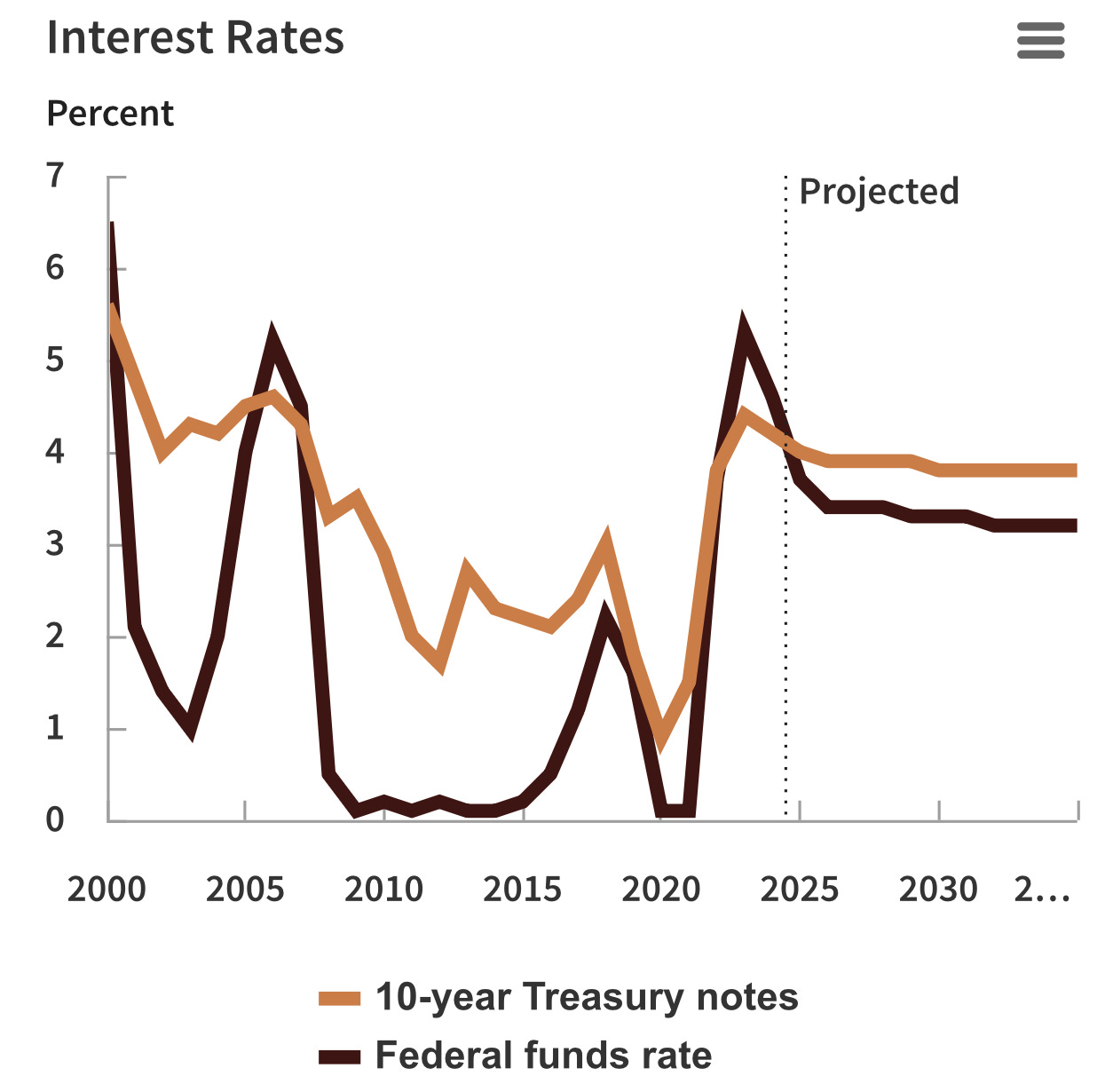

Rising Interest. The first half of the below chart makes a liar out of the second half. The interest rates must go up to tame inflation. CBO projects a miracle, falling interest rates ordered by the president.

CBO predicts rapidly falling interest rates starting…right now! Remember, we pay interest on public debt. Falling interest rates frees up cash. Really great when looking for budget cuts. But a huge cost when interest rates go up.

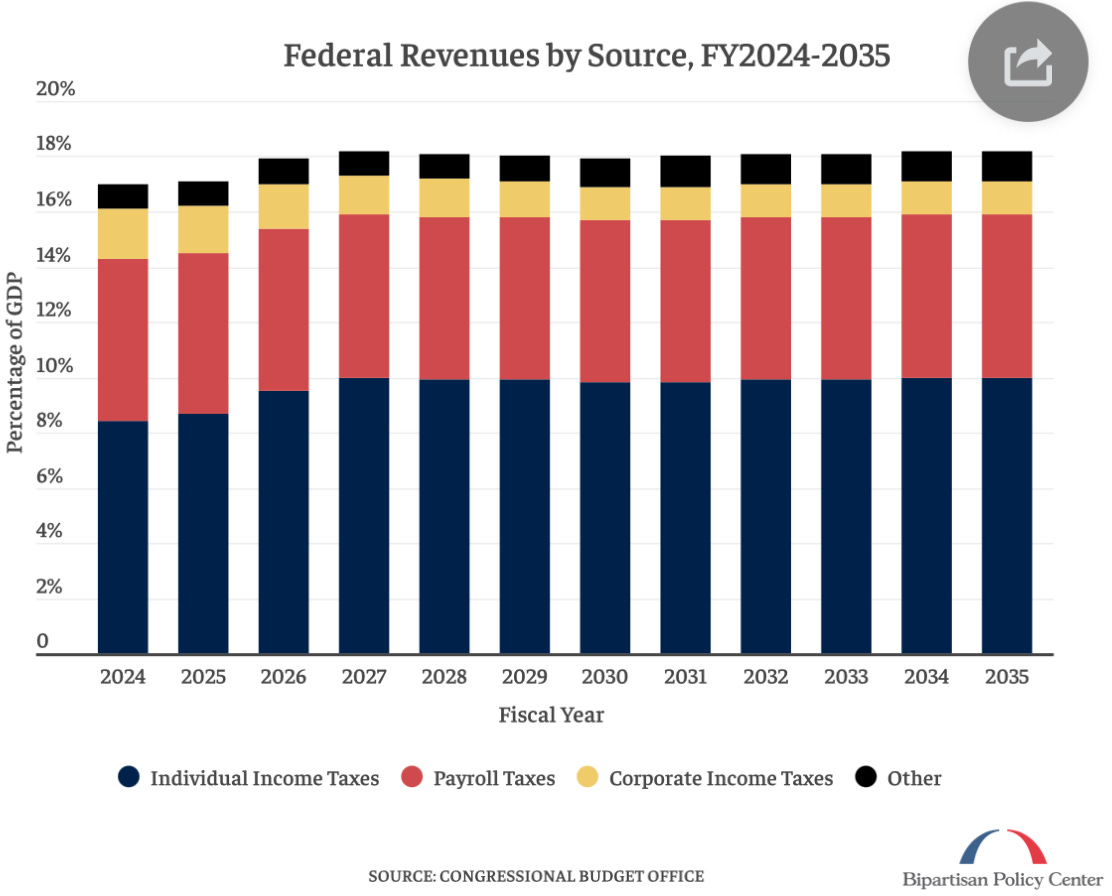

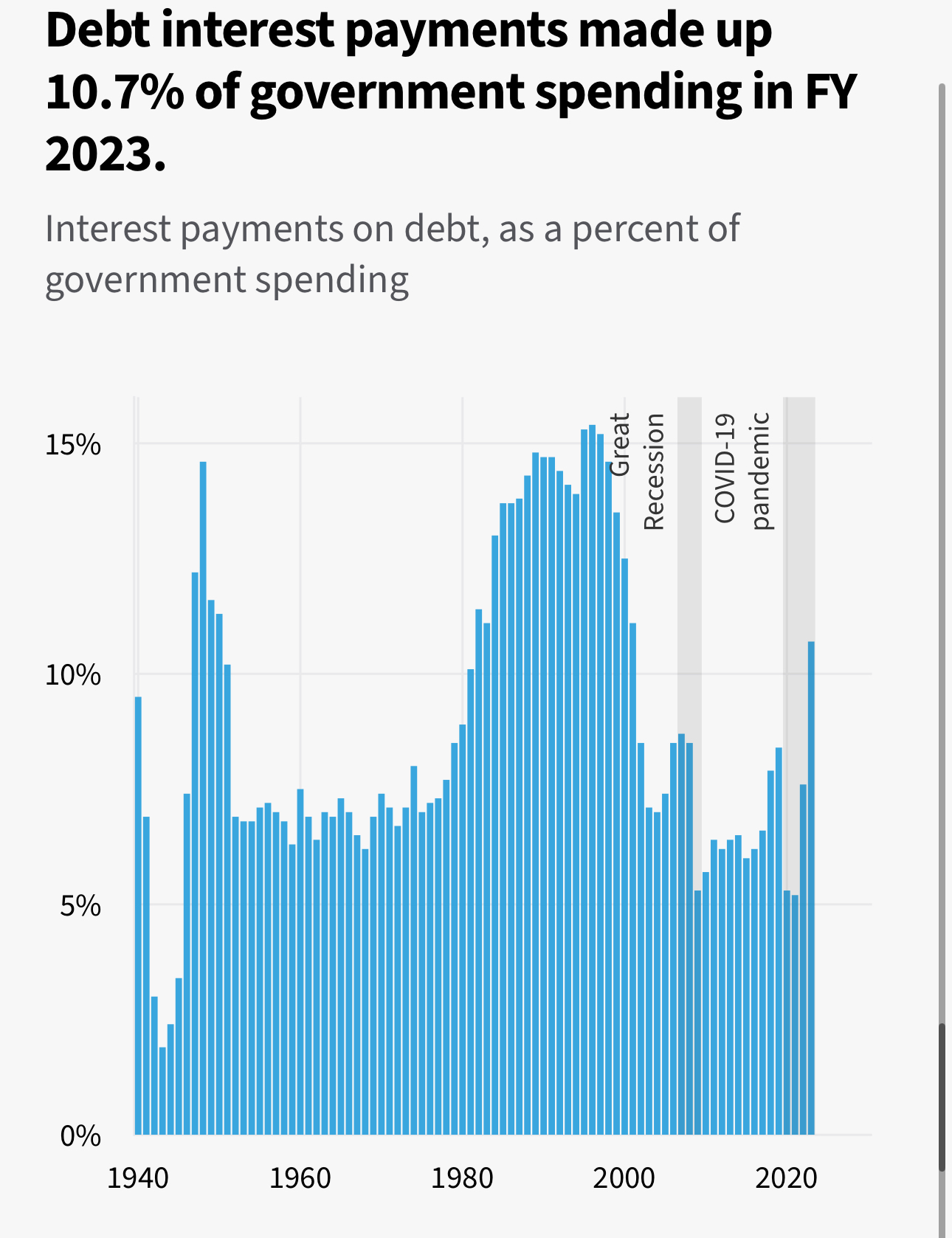

The interest paid to U.S. debt holders is huge, $0.952 trillion in 2025. With deficits adding to debt every year, CBO shows this compared to all outlays. That is sleight of hand. It speaks poorly of CBO advising us on where we are. Income is $4.9 trillion. We are spending 18% of our income on interest payments, while we are borrowing more every year. WE ARE NOT PAYING OFF THE PRINCIPAL. We must get off of this merry-go-round. Where is Bill Clinton?

In 10 years, 36% of our Treasury income will go to interest payments.

You are being lied to and screwed royally by Republicans and the CBO.

It is not the first time.

They do it for every Republican tax cut.

Truth Be Told. Trump and Musk must get a tax cut because of their bitcoin gains. Trump does not care from where the money going into his pocket comes, and he does not pay his bills. You get to pay it.

Why I Don’t Buy the CBO Forecast. The CBO told us the TCJA would break even.

One can see interest payments as one the largest parts of outplays in thE coming years, however, those interest payments are understated. It is going to be much worse than what is shown here.

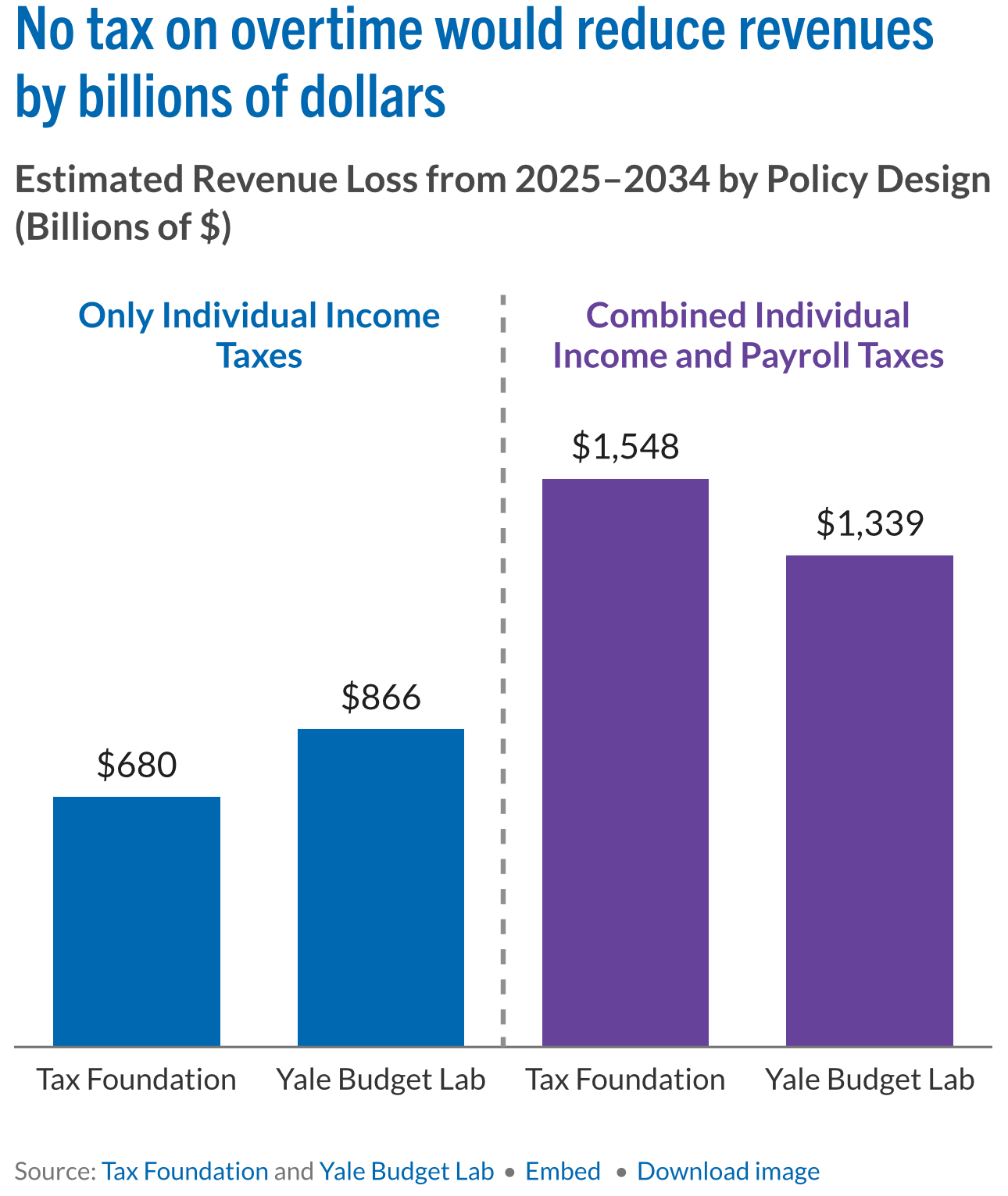

One thing I don’t discuss much: the impact of cutting taxes on tips and overtime. )It took a while to find you credible sources for that information.) I discounted cost by 90% because I don’t see it passing in Congress.

It looks to be a $1.6 trillion cost over 10 years. It will not make it through Congress as pulling out a constituency for a tax break that benefits the wealthy the most is not a good idea.

I hate what the Republicans are doing. Playing games to hoodwink honest Americans. I will spend my time researching and my money protesting this jerk, until they shoot me. That is how I will enforce equitable equality—as Jackson Browne sang—til I go down.

Completely independent—avoiding corporate sponsors and advertisers. Your paid subscriptions are what frees me to write this newsletter. I’m grateful to everyone who sponsors me and who takes the time to read, ponder, vet, and prepare to fight.

Thank you for finding my voice. You have given that place and meaning. And truly, I owe you for that.

Please share. Please become a paid subscriber if you can. Thank you all.

I would like the tax cut to expire. Republicans screw up the economy every damn time they get in office. If either party was serious about saving money, they would hire the best money people to descend on the Pentagon and fix the waste, fraud, & abuse there. I could kick the idiots that voted this destruction to our country.

This was a relatively easy read Carl. Thank you for making it so in addition to your valued analysis.