The $2.6 Trillion Annual Deficit Plan (Updated)

Why a tax cut when we have annual deficit spending of $2.1 trillion?

Explain it to me like I am 10 years old, please. My understanding is that:

• the Senate will begin calculating the 10-yr budget impact WITH the current 2017 tax cut in place.

• Democrats will flag Byrd bill bait for the Senate parliamentarian.

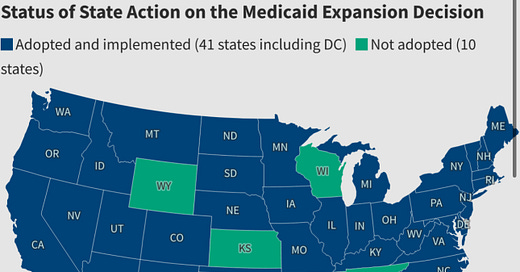

• Republican senators will lie about cutting Medicaid. They are not cutting benefits, they are adding eligibility requirements designed to make many ineligible. Those new eligibility requirements will disqualify 10.4 million says the Congressional Budget Office (CBO).

• Further, there are 14 of 41 states that have Medicaid Expansion with a state law that says Expansion is cancelled if their state endures a change to the Federal cost-sharing program.

• We can color food stamps gone. Today’s Supplemental Nutrition Assistance Program (SNAP) is formerly known as the Food Stamp Program.

• The Senate will not address the cut to Medicare as that cut is not their doing, it is the Pay Go law that if a Continuing Resolution (CR) increases the deficit, Medicare cuts are invoked. That will be $500 billion in Medicare cuts.

Also, Senate and House changes do not consider the 10-year $4.6 trillion impact of the Tax Cut and Jobs Act (TCJA). They are trying a ruse as if the TCJA is going to be the status quo. The TCJA expires this year. Ignoring that is a ruse they hope you miss. They are ignoring the $460 billion/year increase the TCJA adds to the required “deficit neutral” CR bill.

LASTLY, the exemption for overtime in the House budget bill would result in $124 billion in lost tax revenue compared with current policy, and the tax break on tips would reduce tax collections by $40 billion, according to the Congressional Budget Office (CBO).

LET ME STEP THROUGH THESE ADD ONS.

$350 billion added for defense, detention camps, border security.

$50 billion farmer bailout (not identified yet)

$164 billion tips and overtime deductions

Subtotal:

$564 billion added to the ANNUAL budget

NOW ADD THE TCJA’S TAX CUT (Being ignored).

$460 billion TCJA plus $564 billion above added

Subtotal:

$1.024 trillion added to annual current budget (deficit spending)

But we were currently running a

$1.640 trillion deficit (without TCJA)

$1.024 trillion more is being added with TCJA to give us:

$2.664 annual deficit in 2026 and 2027

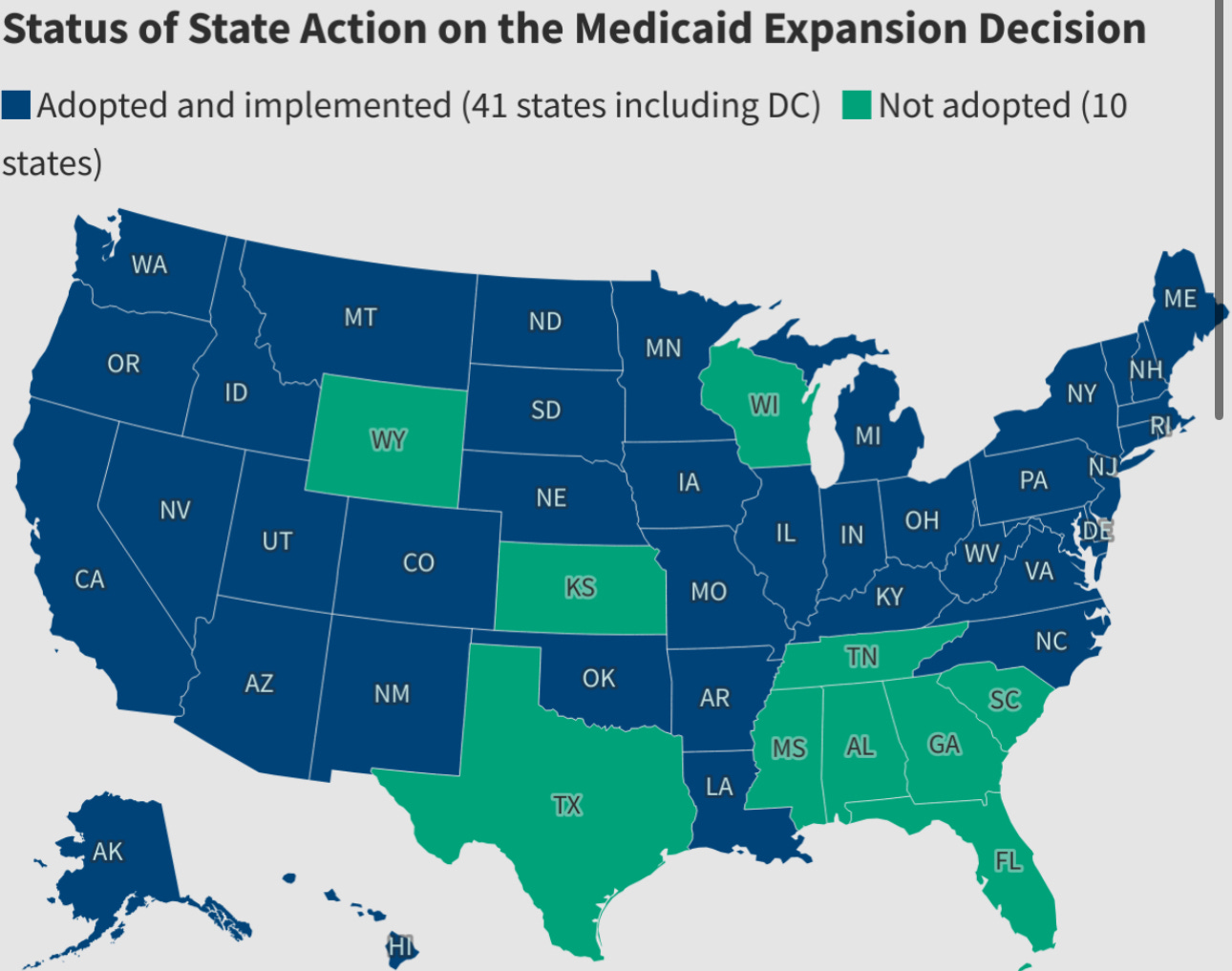

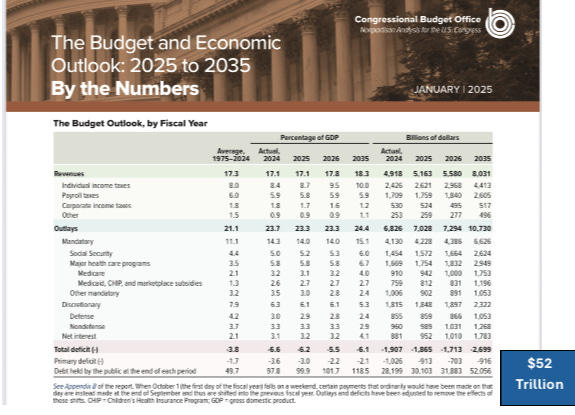

The CBO Projection before the CR Bill.

The $1.907 trillion annual deficit (2024) is imperiled by the current $200 billion we are now over budget in 2025.

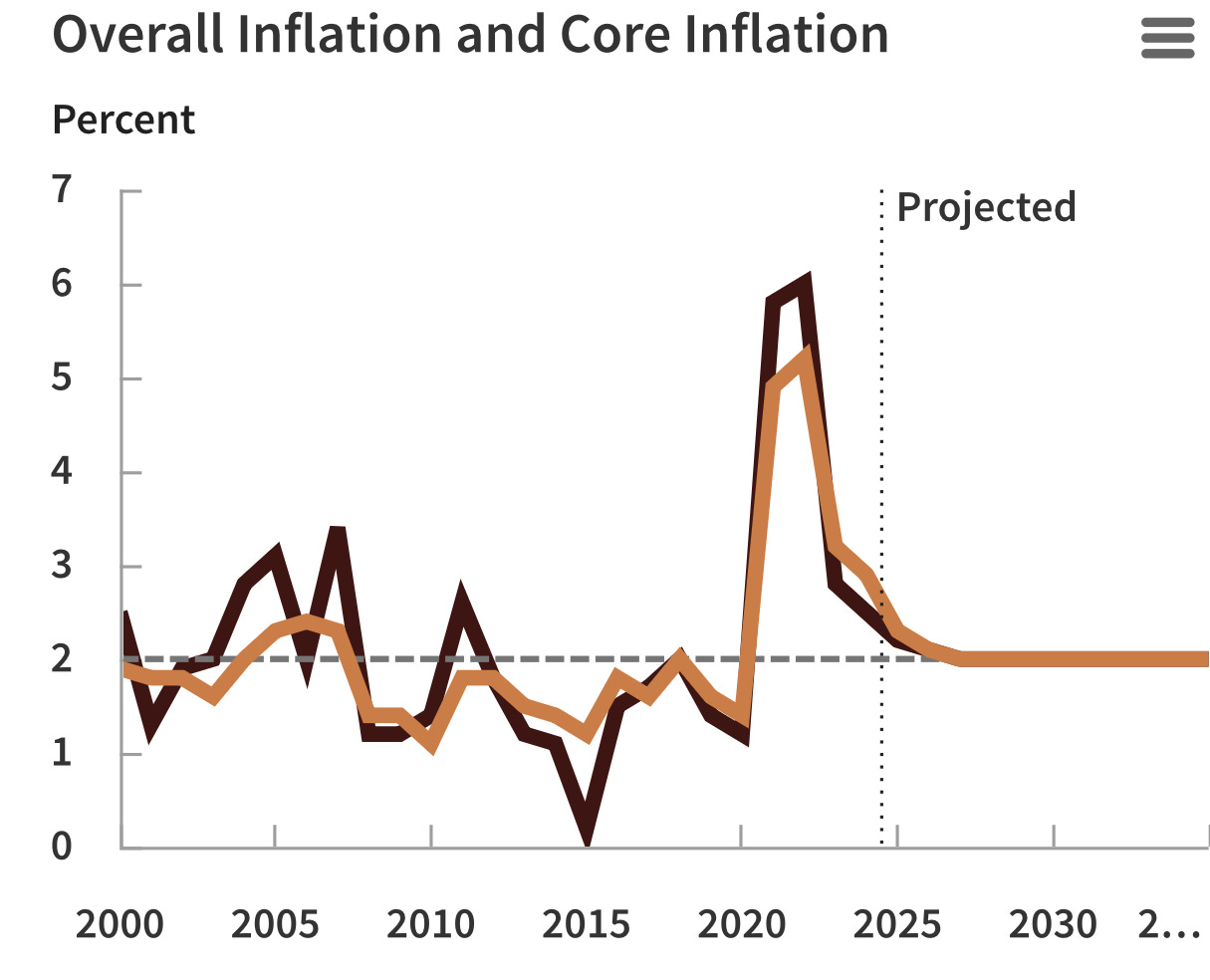

The deficit for 2025 will exceed $2.1 trillion. The CBO projection is rife with unfounded administration-favorable parameters, i.e., 2% inflation rate, 3.5% interest rate, etc.

A Second Opinion

Elon Musk, good at math, just said this:

“This massive, outrageous, pork-filled Congressional spending bill is a disgusting abomination. Shame on those who voted for it: you know you did wrong. You know it. It will massively increase the already gigantic budget deficit to $2.5 trillion (!!!) and burden America citizens with crushingly unsustainable debt.”

Amazing that Elon gets to the same annual deficit number that I do: $2.5 trillion. Over 10 years, that is $33 trillion (including growing interest charges) being added to what is our current $36 trillion deficit. (Think $69 trillion, then subtract their cuts when they expose them.)

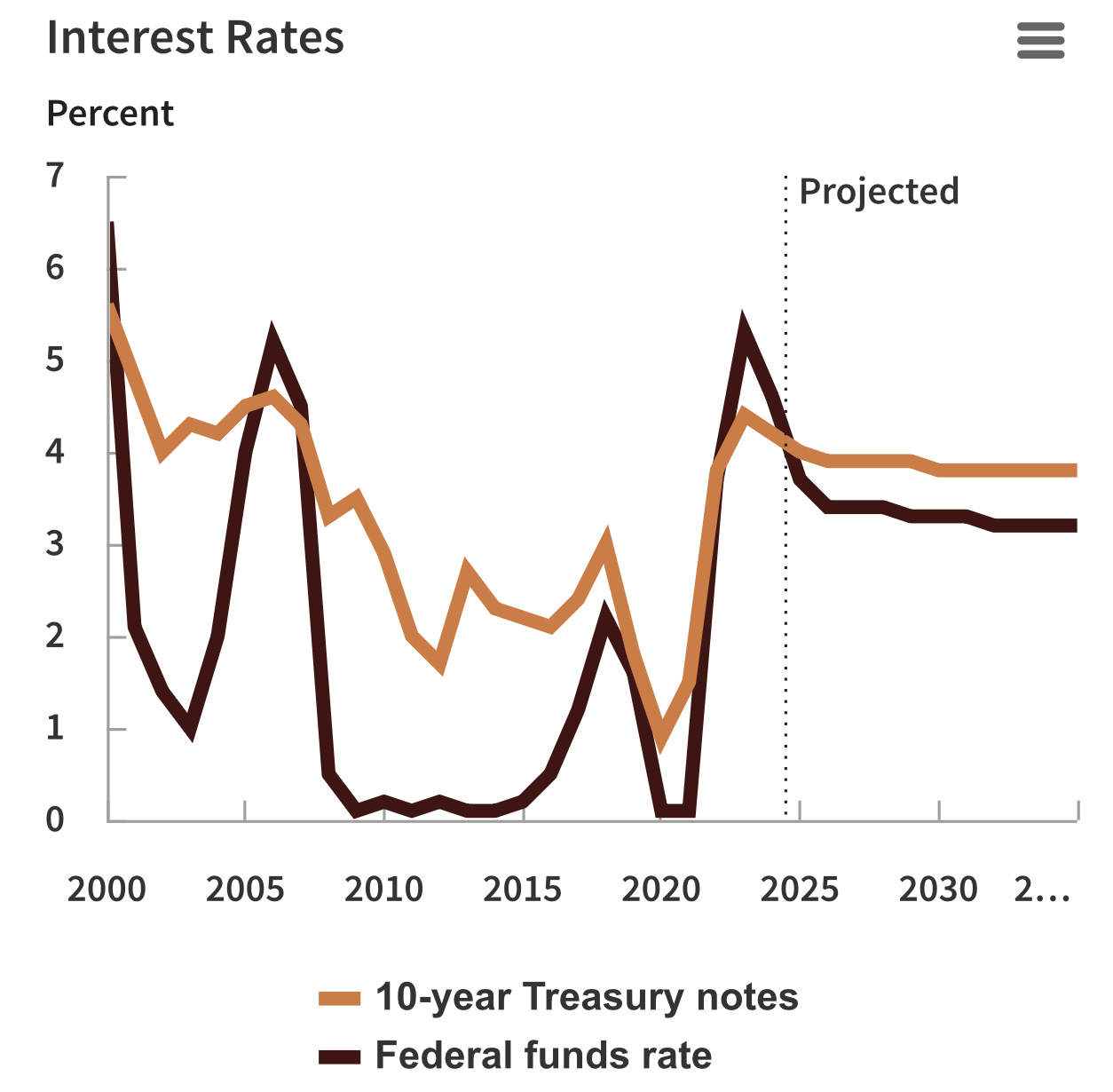

CBO Data. I have taken interest rates into consideration, but not inflation. Interest rates grow as US Treasury bond credit is deteriorating. Our Treasury 30-year bond current rate is $4.91%.

CBO has said they project a $52 trillion deficit before the CR Bill. After they say add $2.7 trillion more. They see $54.7 trillion in total debt. I see more.

The CBO has used 2.0% inflation to do their projection. I call BS there, and expect the end will be worse than I project.

CBO Data. Tariffs say 2% is overly optimistic as an inflation rate for 10 years. I can’t buy that. Hence, I ignore it.

Can we expect a $75 trillion total deficit as the outside marker with real inflation? I can’t get there without playing with inflation, and I am very hesitant to do that.

My max deficit figure is $69 trillion in 2035 not considering inflation. Inflation remains the wild card.

The Total Deficit?

I have calculated all the “adds”. I do no budget cuts as of yet, so where we will be in 2035 remains to be calculated. I do not take into consideration their “slash and burn” cuts. We won’t know what they are until July. My gut says that they may cut $13 trillion over 10 years. (That is $1.3 trillion a year.) Will that saddle us with a $56 trillion deficit? (It kills me to think Susan Collins might be worried. Funny she was not worried about the CBO’s prior estimate of a $52 trillion deficit.)

I am not thinking anything is going to happen. It is just too ugly. You can adjust my numbers that got me to the outside marker of $69 trillion in this simple Excel deficit calculator.

(Every time I meant trillion in this article, I wrote down “billion”. My brain would not allow me to deal with trillions. Double check me please.)

Research. Research. Research. It is time consuming to find the right and the credible source data, but worth it. I kind of think I need to back up my opinions with CONCRETE, so I research.

Demoralized, I have not written much of late. I try to spend my time and money protesting and discrediting the crooks in power. But interest lags sometimes until I get a spark. Getting to the budget impact with deficits accumulating and interest to pay on that was too much of a puzzle for me to ignore. I will do these odd things until they shoot me. That is how I will ensure equitable equality—as Jackson Browne sang—til I go down.

Completely independent—avoiding corporate sponsors and advertisers. Your paid subscriptions are what free me to do the background research and to write this newsletter. I’m grateful to everyone who sponsors me and who takes the time to read, ponder, vet, and prepare to fight.

Thank you for finding my voice. You have given that place and meaning. And truly, I owe you for that.

Please share. Please become a paid subscriber if you can. Thank you all for the inspiration you give to me.

Damned good effort here! I read you 5X5!

How many of us are able to relate to the impact this deficit spending will have? It doesn't seem real, so it won't help us connect the dots. Real life stories will eventually resonate with us, but it'll be too late then.