Where is the path? What do we offer? What can we vote for? Personally, I am stumped.

Josh Siegel, a Democratic state lawmaker from a competitive region of battleground Pennsylvania, called our brand “toxic” and worried that Democrats are still seen as “the party of the comfort class.” Siegel added:

“We are great as an oppositional party…but none of that matters for anything if you don’t have a sense of where you want to take the country. If it’s not transformative.”

Where ya’ going, Dems? That is what I hear from Josh.

I have been taking notes on this subject. I filled in some, but otherwise there are a lot of blanks on my note pads. Josh Siegel can’t say a word about the Plan—that we do not have.

Likewise Ken Martin, the DNC chair, said the party’s big-picture pitch boils down to: “Everyone deserves a chance to achieve the American Dream, to get ahead.” Why, that makes me never want to vote again. EVER.

Touchy, feely, feel good: We’re not going back. When we fight, we win! Achieve the American Dream. BS platitudes. Puke!

My plea has been Give Me Something—for which to vote! Something like:

We will better than balance the budget. We will pay off all debt within a decade.

Saying that, I tell you directly where we are going. That is direction. That is meritorious. That will help the following generations of our get.

Senator Adam Schiff (D-California) gets it. Sen. Schiff suggested that Democrats should become “the party of the next housing boom,” among other things.

“What I think Democrats need to do is not simply rely on the president to defeat himself, which he’s in the process of doing, but rather to make a case about how we are the agents of change now,” Schiff said.

Schiff too is saying “Throw me something, Mister”. That would be New Orleans’ slang shouted at the Krewe to throw me a doubloon or beads on the Mardi Gras parade. Trinkets are at least something you can hold in your hand.

The touchy, feely, feel-good things like below are not what Schiff is saying:

Growing Our Economy from the Bottom Up & Middle Out

Rewarding Work, Not Wealth

Lowering Costs

Tackling the Climate Crisis, Lowering Energy Costs, & Securing Energy Independence

Protecting Communities & Tackling the Scourge of Gun Violence

Strengthening Democracy, Protecting Freedoms, & Advancing Equity

Securing our Border & Fixing the Broken Immigration System

Advancing the President’s Unity Agenda

Strengthening American Leadership Worldwide

The touchy, feely, feel-good 2024 Democratic Platform was missed by so many as it came out late, in August of 2024. Above were its 9 chapters.

I cannot relate to touchy-feely, platitudes, or chick flicks. If it is CONCRETE. If you can hold it. If it is a salve or a bandage on your skin. If it is a hospital bed under you in a good care facility. If it is a roof over your head. If it is a dinner plate with warm, wholesome food. If it is a chicken high on pot (Not, Not for Joyce!). If it is a living wage job, or a subsidy to get you to that income level. I can relate to those CONCRETE things. GIVE ME SOMETHING TO VOTE FOR!

We must answer this question—fast and directly. The answer must be concrete things. Why choose us? I am making a list of touchable, concrete items. I hate touchy, feely platitudes like “to achieve the American Dream”. Those are what I call unsubstantiated claims. Anybody can say that.

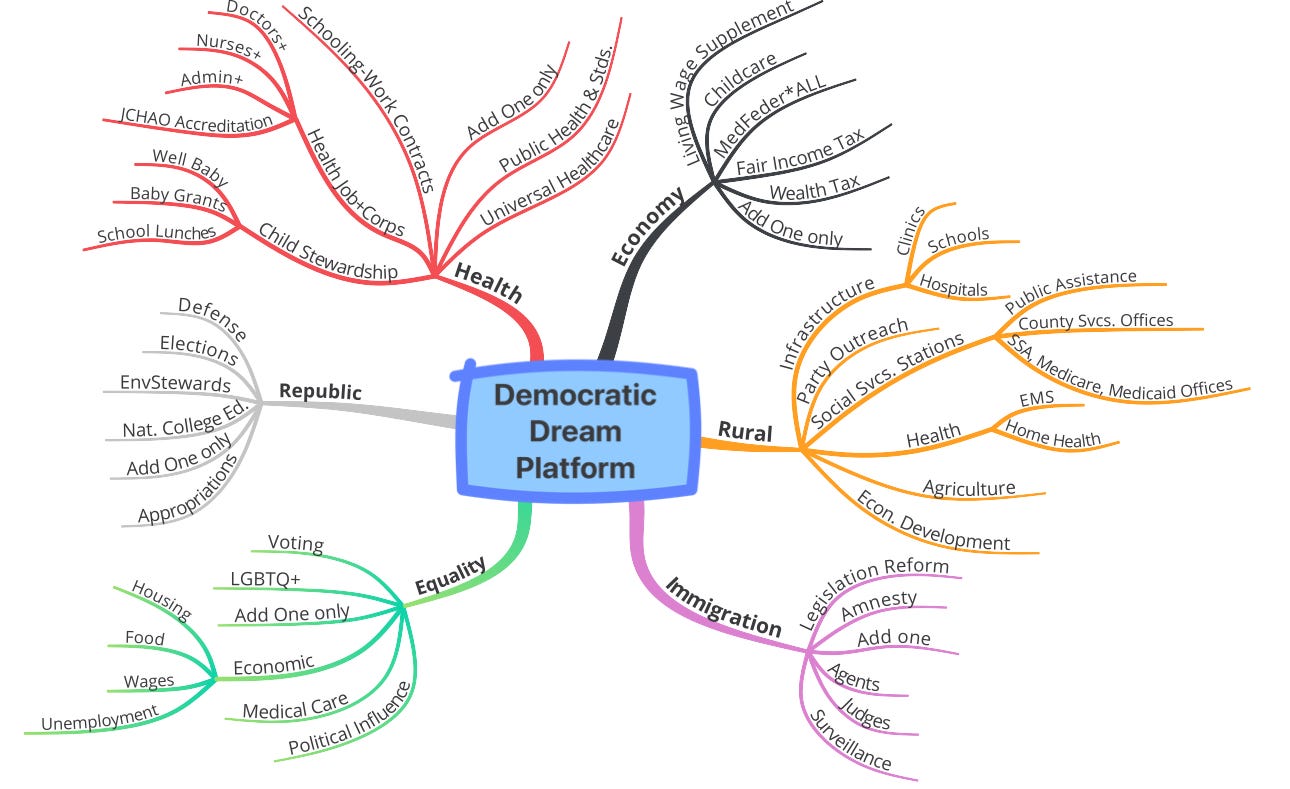

Where I am going, it makes sense to develop the Acts in Congress and present those. The acts will embody what we propose. For instance, The Voting Rights Act of 2029. That would embrace many of the things in the Equality leg of the above Mind Map.

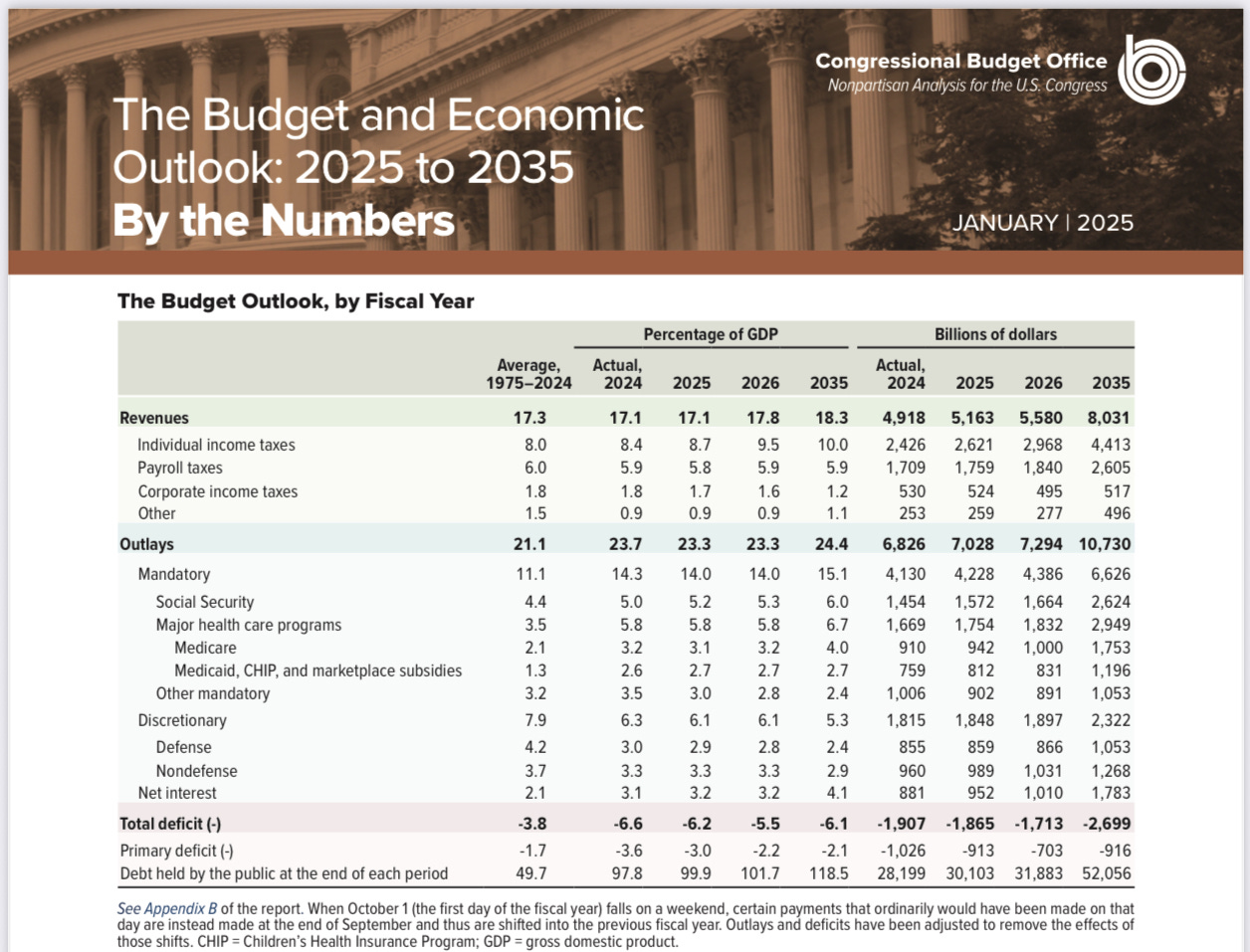

The Planned Budget Cuts. Well…that is a secret. None of the initial plans for specific tax cuts being bandied about are locked in. The additions to the budget do appear locked in. Did CBO pick up on those? No, they did not.

The Total Debt. The total gross federal debt of the United States is $36.21 trillion as of April 23, 2025. This figure represents the total amount of outstanding borrowing by the U.S. Federal Government, including both debt held by the public and debt held by various government accounts. We pay on that debt’s interest every year, nearly $1 trillion in interest paid out this year. That interest is in our annual budget and in our annual outlays. This is disgustingly wasteful. $ 1 trillion a year, people.

Budget Additions. I discussed that there will be $720 billion in new annual outlay ((additions) in my previous newsletter, Over-Budget Chaos.

These new outlays are not in CBO projections yet. These are not being discussed. We need to add that to the CBO-projected, rose-colored $1.865 trillion deficit. I say it is $$2.6 trillion of money we do not have. We have no reason for deficit spending now.

The current status means I will start with $2.6 trillion in deficit spending (borrowings) to measure realistically the debt accumulation and the interest on the ballooning debt (loans). I will try to calculate that, starting with $2.6 trillion added to our $36 trillion debt for 2025. Then we must also add the growing interest payments.

CBO and the House Will Hide Facts. No matter what the President wants, the House is stonewalling to do a sleight of hand. The CBO will play along blindly until something is official. How convenient. That is either malfeasance of the House, or devious behavior of the CBO, or some of each. (You choose.)

Bottom Line Up Front. In 2035, the deficit will be $66 trillion on which we will pay $3.03 trillion per year interest. This simple chart shows where we are going, unless we fix the debacle.

Their New Tax Cut. I don’t factor that yet. Nevertheless, this next tax cut will be a slapdash, late-at-night fiasco for them to approve their new budget. There is so much opposition that I ignore the issue entirely. They will not get their desired spending reductions, but they will force through their tax cut for the wealthy anyway. They lack the ability to govern, so they have been using Nancy Pelosi’s budget for years now. I think right now that their big spending cuts will be in:

Medicaid. The House Energy and Commerce Committee is eyeing Medicaid spending as a potential for slashing to hit its goal of $880 billion in savings over the next decade. That could involve revoking state Medicaid expansions, which would potentially reduce healthcare coverage for 15.9 million people. They don’t care. On average, each congressional district would lose $2 billion in federal funding over 9 years. Kiss rural hospitals goodbye.

SNAP. Another option includes major reductions in food assistance under the Supplemental Nutrition Assistance Program (SNAP), which falls under the House Agriculture Committee’s purview. The 2023 SNAP outlay was $113 billion to 42 million of our poor and needy. Again, they don’t care. Yes, they will take food from babies to get their tax cut for the wealthy. The American people care and will not let them. That, I pray.

Total Chaos. This “cut outlays” business is all a secret now, but they must come up with these new budget cuts. They are shuffling the cups with a pea under one. It is all a blur right now.

A Blur, On Purpose. One cannot target what they are doing until they say what it is. Would Mike Johnson hide the plans? They said they will cut the spending programs like about an annual $1.5 trillion ($15 trillion over 10 years). Then they said they will extend the TCJA ($500 billion/year) and do another tax cut bill to boot. Cut tax revenue? I kid you not. Won’t that new tax cut add to the deficit?

I THINK IT DOES.

Every penny of both tax cuts is deficit “spending” for which we must get a loan to cover.

Our Interest Payments. The INTEREST paid to U.S. debt (loan) holders is huge, $1 trillion in 2026. Interest is projected at $1.8 trillion in 2035 (CBO data). My data says $3.03 trillion. This interest payment increases the deficit, thereby counterintuitively adding to our debt every year.

The CBO shows these interest payments and their growth; however, CBO compares deficits to all outlays. (Outlays include deficits.) That is sleight of hand. We should compare deficits to income, just like you do at home. Doing otherwise makes the deficit seem more agreeable…only 10% instead of the real 18%. That speaks poorly of CBO advising us on where we are. This is where we are:

The annual deficit spend is $1.865 trillion for 2025. CBO projects 2035 deficits running $2.7 trillion. Oddly, with my additions, deficits will run $2.6 trillion this year, not in 2035. I project 2035 to have us at $66 trillion in total debt, not the $52 trillion CBO projected.

Treasury income is $5.163 trillion for 2025. CBO projects 2035 Treasury income of $8.031 trillion

Interest paid on U.S. debt is $0.952 trillion for 2025. We now spend 18.33% of our income servicing our debt.

CBO projects this interest payment to be $1.783 trillion in 2035. That would be 22.2% of our income that year.

I see that interest being $3.03 trillion per year in 2036 because of higher deficits and interest. Using interest rates that start at 3.6% and grow to 4.5% in 2035, we will need 35.4% of our income to pay the 2035 interest on the debt.

CBO Projection to 2035. We are now spending 18% of our income on interest payments.

Deficits and Inflation. We are borrowing more every year, yet the CBO projects we will have a lower deficit in 2026, $1.8 trillion. I do not address inflation, but do not hold with CBO’s flatline 2% inflation per year. When did we ever do that?

CBO has not calculated the new budget additions. I call BS. CBO says the deficit is projected as growing to $2.7 trillion in 2036. I call BS, again. The CBO missed the new $720 million in annual outlays; hence,

the deficit will be much larger, and

borrowings will be much higher.)

The CBO says inflation will be 2% for the decade. I call triple BS. I have never seen that. I have seen 12% inflation a year, but I do not factor inflation. Tariffs on everything will balloon inflation, I believe. We are at 2.3-2.4% inflation now.

Interest Rates. This means interest will go way up and be compounded for 10 years. The CBO says interest rates for Treasury bonds will hold at 4%. They are at 4.4% now. Realistically, I see U.S. Treasury bond interest rates creeping up 0.1% a year to 5.5% by 2035. (I calculated projections with lower rates (3.5-4.5%).

I think higher interest rates are what is needed to attract bond buyers to this financially stressed marketplace. We have lost financial credibility, and countries are dumping their bonds at a discount. Take a look at the summary projection through CBO’s rose-colored glasses.

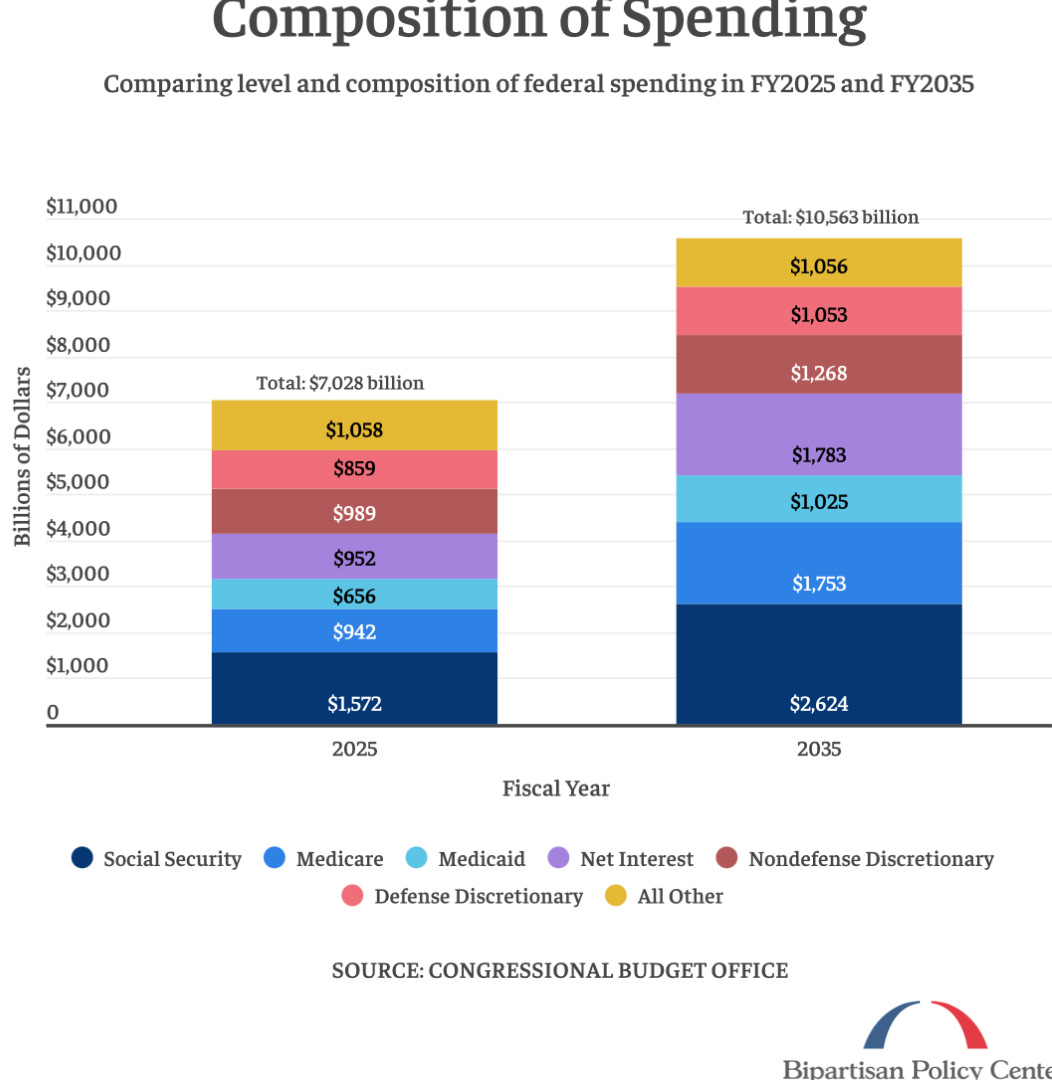

Higher inflation rates, higher interest rates, budget additions ($720 billion/year), and the new tax cut will wreak havoc on the CBO projection above. Total spending in 2035 will be 20% higher unless we take action.

Here are three things we can do to rebuild our credit worldwide.

Stop deficit spending

Appropriately tax the wealthy and corporations, and

Pay off our debt.

That said, CBO will NOT use higher inflation rates and higher interest rates in their projections because those future rates are unknowns. That is CBO’s out. CBO will argue about it, but there is no way to prove them wrong.

It serves CBO and the President’s purposes to make these two rates appear as low as possible to help justify the tax cut for the rich. I expect that.

However, the funny looking numbers in the CBO projections undermine our credit credibility. Bond buyers are astute. BS undermines CBO’s projected borrowing interest rates, and astute buyers will set the actual interest rates. Forget the CBO-projected 4%.

Balance the Budget. Things I see to cut are interest payments and Defense. Things I see to grow revenue are taxing the rich and corporations appropriately.

WE HAVE TO GO BACK TO A BALANCED BUDGET. We are not paying off the debt principal and we must do that. We must get off of this “borrowed money merry-go-round” with $1 trillion in annual interest payments. Have they gone mad? $1 trillion in interest payments? Where is Bill Clinton?

We must balance the budget now. We can do that. Why not? We have no logical reason to be running a deficit now. What, to give more bombs to Israel?

We need new laws to do that. A balanced budget law that says debt and interest payments in 2036 will both be $0.00. I have a goal for us: get the understated PURPLE out of the above chart. (INTEREST will be $1.1 trillion higher than shown for 2036.) The future looks much worse to me than CBO’s projection. CBO gave us the bogus numbers for the TCJA that will cost us $4.6 trillion over the next decade. Shoot the TCJA down!!!!

Cut the Sacred Cow, Defense. There! I said it!

Why? Defense spending has gotten out of hand. It is a routine increase, $1 trillion a year now.

If we reduce Defense spending to 2% of GDP, we will still be spending nearly twice what China, the Number 2 spender, spends.

We Must Cut Excess Defense Spending. We should cap Defense spending at 2.0% of GDP. That is exactly what we ask all NATO countries to spend. That would cap 2026 Defense spending at $586 billion, saving $411 billion a year. We can cut the Air Force’s airplanes, the Navy’s ships, and the Army’s fielded equipment. Those can be divested to prepositioned storage, NATO partners, and Ukraine. Thus we don’t lose that war reserve power, and we cut out our logistics burden (training, maintenance, spare parts, and staffing labor) while gaining spare parts sales customers. The adage is “Guns or Butter”. That adage will always be true. In times of peace, give me the butter.

Cut Both the TCJA and the New Tax Cut. I venture to say that this alone will generate $1 trillion/year in revenue. The TCJA has turned out to cost us $500 billion/year.

Tax Higher Income, Wealth, and Corporations. Increase these taxes by $3 trillion a year. (Work backwards from there to set the new tax rates.) It is time to pay the piper. Eisenhower said tax corporations 90% on profits. It will not take that much. I am talking about taxing corporations that give $270 million in 1 year to political parties. Nix the obvious kickbacks. That will free up corporate budgets to pay taxes.

Summation. Creating this new revenue and cutting Defense will give us $4.4 trillion more with which to work. We can cut out the $1.8 trillion annual deficit and pay a healthy $2.6 trillion on the $36 trillion debt.

That should have us out of debt in 2036. Buying back the high interest debt first will reduce interest payment outlays the quickest. Maybe. So what if it takes until 2040. The effort is what will improve our worldwide financial credibility, and that will reduce new bond sale interest. Oh wait. We won’t need new bond sales. That is so hard to imagine, to sense.

Talk about brainwashed with “Deficits Are Normal.” They are not. Deficits are for emergencies only.

I hate what the Republicans are doing: increasing the deficit to get a tax cut; stealing from your children and grandchildren simply to line their own pockets; playing games to hoodwink honest Americans into thinking there are emergencies afoot. There are none, except I have to decide today whether to go to Sam’s Club or Walmart.

I will spend my time researching much more. It is time consuming to find the right and the credible source data, but worth it. Research limits my output of posts per week, but I kind of think I need to back up my opinions with CONCRETE. I hold CONCRETE dear.

I will also spend some time and money protesting. I will do these things until they shoot me. That is how I will ensure equitable equality—as Jackson Browne sang—til I go down.

Completely independent—avoiding corporate sponsors and advertisers. Your paid subscriptions are what free me to do the research and write this newsletter. I’m grateful to everyone who sponsors me and who takes the time to read, ponder, vet, and prepare to fight.

Thank you for finding my voice. You have given that place and meaning. And truly, I owe you for that.

Please share. Please become a paid subscriber if you can. Thank you all for caring. .

---> Cut the Sacred Cow, Defense. There! I said it!

---> Tax Higher Income, Wealth, and Corporations. Increase these taxes by $3 trillion a year.

^^^ THIS!!!

I’m not wasting my time with this anymore. I don’t need to read your criticism of the people who are opposing the evil king. Just more division and destruction. Good bye.